Manual fare collection might seem outdated, but even today, many public transit systems still rely on it.

On the other hand, many developed cities around the world use fully automated fare collection systems. However, they, too, mostly rely on open-loop payments.

In both cases, what often gets overlooked is the weakest link: security.

From revenue leakage and ticket fraud to data exposure and compliance issues, fare collection systems are increasingly vulnerable, especially as cities digitize without full control over their infrastructure. A single breach can undermine public trust and put operators like you on the defensive.

That’s where closed-loop Automated Fare Collection (AFC) systems can help you, not just as a transit payment solution, but as a long-term safeguard for transit authorities like you who want both control and confidence.

So, how do these systems do that?

That’s exactly what you will know in this blog. Plus, we will break down the common risks in transit fare collection and how a closed-loop approach can help you stay ahead of them.

Let’s start with some vulnerabilities in manual and semi-automated fare collection methods.

Security blind spots in manual and semi-automated fare collection

Before digital systems, fare collection meant paper tickets, cash payments, and human validation. Some public transit systems still operate this way. Others have added a layer of semi-automation, like digital/mobile ticket issuance, but without rethinking the process end-to-end. Both come with serious vulnerabilities.

Lack of transparency and audit trail

You can’t manage what you can’t measure. Without real-time transaction records, it becomes nearly impossible to track how many tickets were issued, what was collected, and what was lost. This lack of visibility makes internal fraud easier to hide and harder to investigate.

Human-led fare handling = higher fraud risk

Whether it’s staff manipulating fares or passengers bypassing checks, manual systems give too much room for error and intentional abuse. Without digital enforcement, fare rules are only as strong as the people enforcing them.

Cash transactions enable internal theft

Physical cash always carries risks like delayed deposits, skimming, and untraceable losses. And when reconciliation is manual, there’s no immediate way to detect irregularities.

No real-time monitoring or enforcement

Most importantly, manual and semi-digital fare systems offer no immediate alerts when something goes wrong. That delay can turn small losses into long-term revenue damage.

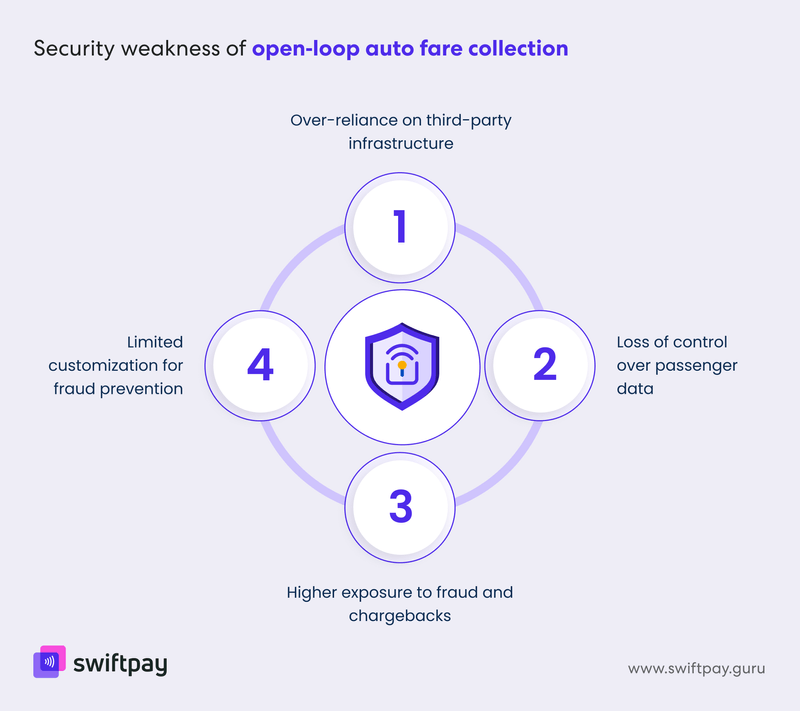

Vulnerabilities in open-loop fare collection systems

Many transit agencies have turned to open-loop payment systems that allow passengers to use their bank cards directly. While it may appear more convenient, this approach also introduces a number of operational and security challenges.

Over-reliance on third-party infrastructure

Processing open-loop payments means depending on external networks, banks, and payment service providers. Any downtime or disruption in those systems can directly impact fare collection. You’re essentially handing over your core function—ticketing—to someone else’s ecosystem.

Loss of control over passenger data

With open-loop payments, sensitive rider data like transaction records, travel history, payment methods, etc., is shared across multiple third-party platforms.

This complicates privacy compliance, and it also opens the door to misuse, breaches, or external monetization.

Higher exposure to fraud and chargebacks

Bank-issued cards can be lost, stolen, or cloned. Open-loop auto fare collection systems are more vulnerable to misuse because they’re not built for the nuances of transit.

Besides, when disputes arise, like failed payments or reversed charges, the burden often falls on the transit operators like you.

Limited customization for fraud prevention

You’re constrained by the features of the external system. Fraud rules designed for other industries don’t always apply to transit operations, where real-time validation and route-based pricing are essential.

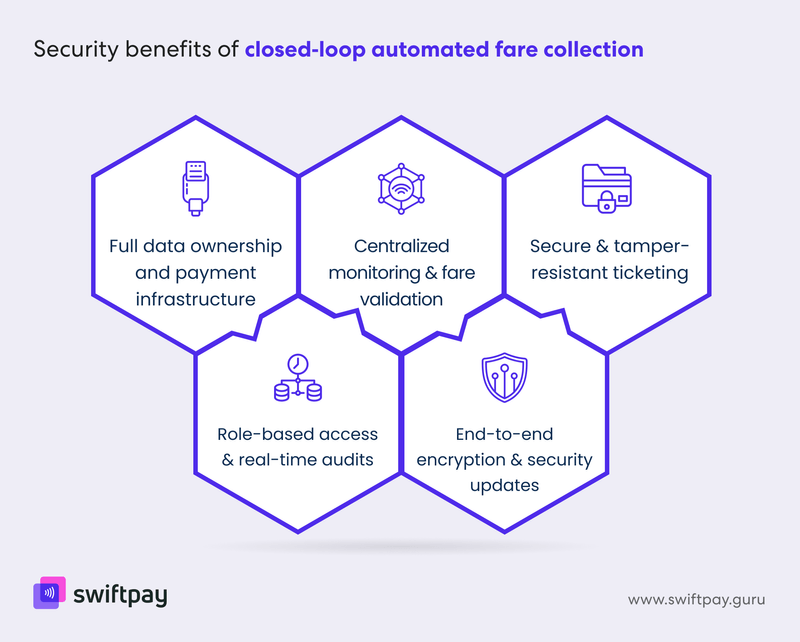

How closed-loop AFC strengthens security and prevents fraud

When it comes to security and fraud prevention, closed-loop AFC systems offer a fundamentally better path.

Unlike open-loop systems, a closed loop AFC system is fully owned, operated, and controlled by the transit authority like yours. Passengers use transit-issued cards, QR codes, or closed loop e-wallets that operate within a self-contained ecosystem.

Let’s explore the core security advantages built into this model.

Full ownership of data and payment infrastructure

With a closed-loop automated fare collection system, you control every element of the fare process - from the moment a ticket is issued to when the transaction is settled. Payment gateways, user data, top-ups, validations - it all happens within your infrastructure.

This eliminates the risk of third-party interference and makes it much easier to comply with local data protection laws. There’s no need to share passenger information with banks or external processors. You set the policies, manage the records, and enforce compliance.

Centralized monitoring and validation logic

Every fare transaction is recorded, verified, and stored in real time. This gives you immediate visibility into patterns, anomalies, and red flags. Whether it’s an unusual number of top-ups at a single terminal or a surge in rejected validations, your system is equipped to spot and respond to potential fraud.

This centralization also makes it easier to coordinate across different routes, modes (bus, metro, ferry), or zones. Fare enforcement becomes consistent, and discrepancies are easier to audit.

Secure and tamper-resistant ticketing

Closed-loop automatic fare collection systems allow for dynamic ticketing formats—QR codes with embedded metadata, NFC taps with timestamp validation, and secure digital passes. These tickets are hard to fake, and they expire or deactivate based on rules you define.

For example, you can issue a QR code that’s valid only for one trip on a specific route within a 30-minute window. This level of control simply isn’t possible with bank-issued cards.

Role-based access and real-time audits

Security is not limited to preventing external fraud; it’s also about limiting internal risk. Closed-loop AFC systems offer fine-grained access controls that determine who can view, modify, or authorize transactions. Every action is logged, traceable, and auditable.

That means if something goes wrong, you don’t have to sift through disconnected logs across multiple platforms. The entire history is available in one place, clearly linked to users and time stamps.

End-to-end encryption and regular security updates

Transactions within a closed-loop payment system are encrypted at every stage: during data transfer, processing, and storage. Tokenized e-wallets ensure that sensitive card details are never exposed.

And because the system is purpose-built for transit, updates and patches are applied centrally. That means faster response to security vulnerabilities, without waiting on third-party providers.

A security comparison between open-loop and closed-loop auto fare collection

The below table shows various distinctions between open-loop and closed-loop AFC across different security parameters:

| Factor | Open-Loop AFC | Closed-Loop AFC |

|---|---|---|

| Data Ownership | Shared with banks, PSPs | Fully owned by transit authority |

| Fraud Risk | High due to open card usage | Low due to closed environment |

| Custom Rules & Controls | Limited flexibility | Fully customizable |

| Dependency on Third Parties | High | Minimal |

| Real-Time Monitoring | Not always available | Centralized and real-time |

| Compliance & Privacy | Complex, multi-party | Simplified, direct control |

| Ticket Validation Security | Bank transaction = ticket | Dedicated, transit-specific validation |

Read more: Closed Loop vs Open Loop AFC: What Transit Operators Need to Know

Final thoughts

You can’t afford to treat fare collection as a basic transaction process. It’s a critical infrastructure layer - one that directly impacts revenue, public trust, and operational control.

The more hands you let into your system, the more risk you take on. Whether you're battling fraud, dealing with compliance pressure, or struggling with revenue leakage, the root issue is often the same: lack of control.

But—as you have seen—closed-loop AFC systems reduce that risk and help you gain back that control. They give you the visibility, ownership, and safeguards needed to run secure, efficient, and transparent transit operations.

With SwiftPay, you get full ownership of your fare infrastructure—no dependencies, no data risks, no third-party blind spots.

It's a purpose-built, secure platform that gives you real-time visibility into transactions, automates compliance, and makes fraud prevention part of your daily operations, not a crisis response.

If you’re serious about securing your fare system, SwiftPay’s closed-loop AFC solution gives you the tools and control to do it right.