According to a recent report by Future Market Insight, the electronic toll collection (ETC) market is projected to reach USD 43.89 billion by 2035.

This is a clear indication that people around the world demand digital toll payments that are seamless and convenient.

Toll roads once meant waiting in queues to pay and verify vehicles, manual payments, and frustrating commutes. But that has changed now.

Across the globe, technological advancements and road users’ expectations pressured toll operators and agencies to modernize the toll collection process.

Mobile-based toll payment apps have now become the norm in many cities.

For operators like you, this means lower hardware costs, streamlined maintenance, and gaining real-time insight into road usage.

This blog dives into the impact of mobile apps on toll payments worldwide. Here’s what you will get to know:

- How mobile apps are revolutionizing toll payments

- How it streamlines operations for toll operators like you

- How closed-loop payment systems for tolls are quietly becoming the preferred model for toll operators aiming to reduce costs, build loyalty, and simplify management.

Let’s dive in.

The evolution of toll payments: From cash to contactless mobile payments

Toll collection used to be a cash-heavy, labor-intensive process. But now it’s moving swiftly toward digitization with the help of mobile apps and contactless payments.

This shift isn’t just about new technology; it’s also about solving persistent inefficiencies while meeting the demands of modern road users.

The limitations of traditional toll payment methods

Traditional toll payment systems have long presented challenges that impact both road users and toll operators like you. This includes:

- Traffic bottlenecks due to manual cash collection

- High labor costs and infrastructure maintenance

- Revenue leakages through fraud, misreporting, or errors

- Poor user experience, especially during peak hours

- Lack of data to support informed decision-making

The population keeps increasing. Cities keep expanding. And that naturally results in rising volumes of vehicles, which makes these limitations even more pronounced.

The rise of digital payment solutions

To overcome the challenges due to the traditional toll collection process, toll operators around the world have adopted a mix of RFID tags, prepaid cards, and contactless systems.

Among them, mobile apps are the most flexible and scalable solution for toll payments.

Let’s see some prominent examples of mobile app-based toll collection systems:

-

FASTag (India): This system is operational across most national highways in the country. It enables RFID-based toll deductions linked to mobile apps.

-

GoToll (USA): This toll payment app lets users pay for tolls using their smartphone across lanes throughout Virginia, North Carolina, Georgia, California, Illinois, and Florida. All the user has to do is download the app and add their license plate and bank card.

-

SimplyGo(Singapore): This is an all-in-one app for Electronic Road Pricing (ERP) and carpark payments in Singapore. Users can link their contactless credit/debit card or mobile wallet to the app to pay for public transport and tolls.

As smartphones become universal, toll payment apps represent the next step in delivering secure, instant, and adaptable payment experiences.

Reasons behind the shift to mobile apps for toll payments

So, what’s driving toll operators like you to move toward toll payment apps?

The answer lies in a blend of user convenience and backend efficiency:

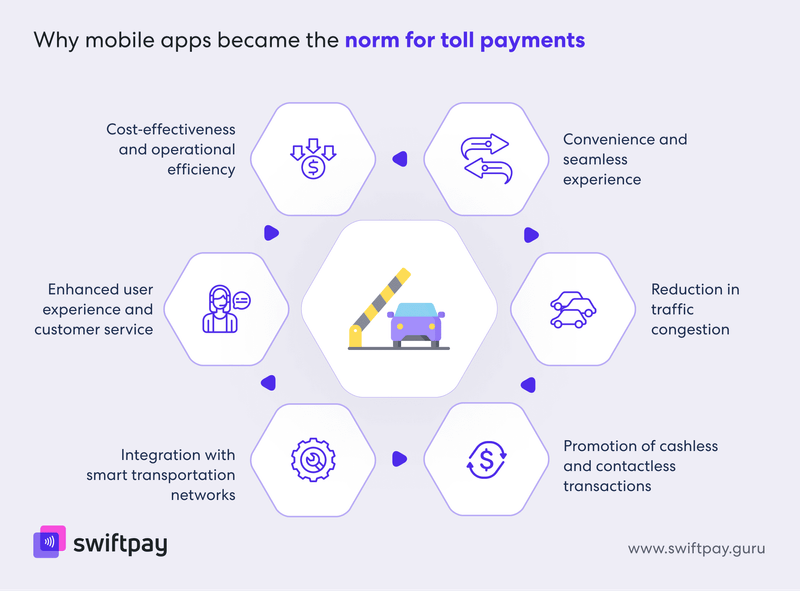

Convenience and seamless experience

Mobile toll apps eliminate the need for users to carry cash, stop for payments, or rely on multiple systems. Payments happen in real time, directly from the linked app wallet or account.

Reduction in traffic congestion

By enabling non-stop tolling, mobile apps reduce queues at toll booths, cut down emissions from idling vehicles, and improve overall traffic flow.

Promotion of cashless and contactless transactions

Automatic toll collection through apps is hygienic. Contactless payments—a feature that gained importance during the pandemic—continues to be valued by users, especially those who are health-conscious.

Integration with smart transportation networks

Toll payment apps can integrate with GPS, real-time traffic data, and smart mobility platforms to offer route suggestions, congestion alerts, and toll cost estimations.

All these features are quite handy for frequent road users.

Enhanced user experience and customer service

Operators like you can push app notifications, offer instant support, or provide trip summaries that keep users informed and in control.

This builds trust and confidence among users.

Cost-effectiveness and operational efficiency

Mobile-based toll payment apps reduce the need for physical infrastructure, maintenance-heavy booths, and labor.

This helps you achieve significant long-term savings.

Read more: How Closed-Loop Payments Improve Toll Collection Efficiency

What drivers want from toll payment systems

For tolling apps to succeed, they must meet the evolving expectations of today’s road users. Here’s what matters most to them:

A frictionless, fast experience

Users don’t want friction when they�’re on the road. They expect tolls to be deducted automatically as they pass, without stopping, scanning, or logging in.

Real-time trip and balance visibility

Users appreciate transparency. They want to see toll charges, balances, recharge status, and past trips instantly. The easier you make it accessible, the better it is.

Cross-region and multi-operator usability

Fragmented systems frustrate road users. An ETC app should ideally work across multiple states, operators, or even countries.

Personalized alerts and reminders

Whether it’s a low-balance warning or a toll cost preview before a trip, timely alerts improve reliability and build trust.

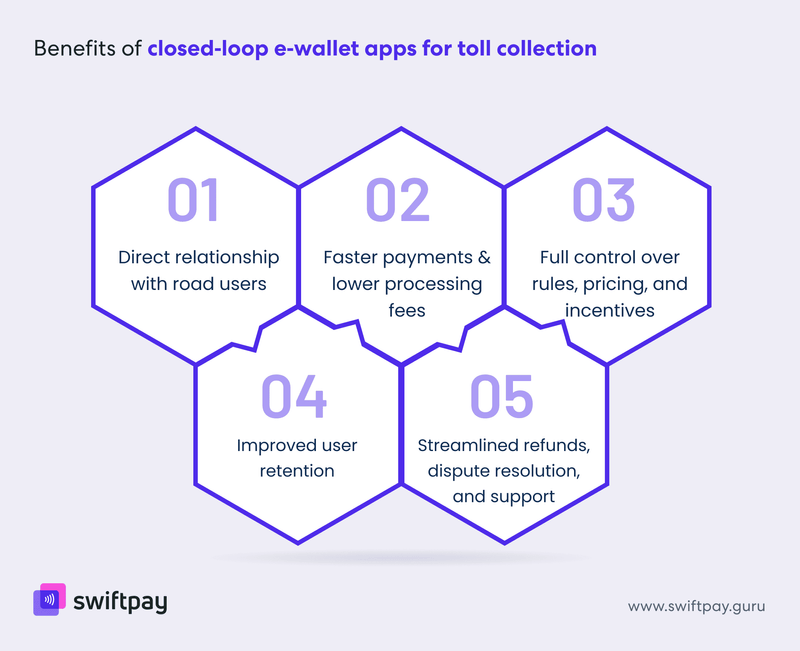

The role of closed-loop e-wallet mobile apps in toll payments

Among the various types of toll payment apps, closed-loop e-wallets offer the most potential for long-term impact.

These systems are operator-controlled and designed to keep users inside a unified payment ecosystem. Let’s explore what these wallets offer you:

Direct relationship with road users

A closed-loop toll payment app lets toll operators like you interact directly with road users without any third-party banks or intermediaries. This builds stronger brand visibility and trust.

Faster payments & lower processing fees

Closed-loop payments are settled instantly within the ecosystem. This minimizes delays and cuts costs related to external payment processors or card networks.

Full control over rules, pricing, and incentives

Operators like you can implement their own loyalty programs, time-of-day pricing, or discounts for frequent commuters—all tailored in-app.

Improved user retention

When a user loads funds into your closed-loop wallet app, they're less likely to switch to another platform. It encourages habitual usage and loyalty.

Streamlined refunds, dispute resolution, and support

Issues can be resolved faster when you own the entire payment flow. There’s no need to chase banks or third parties for transaction errors.

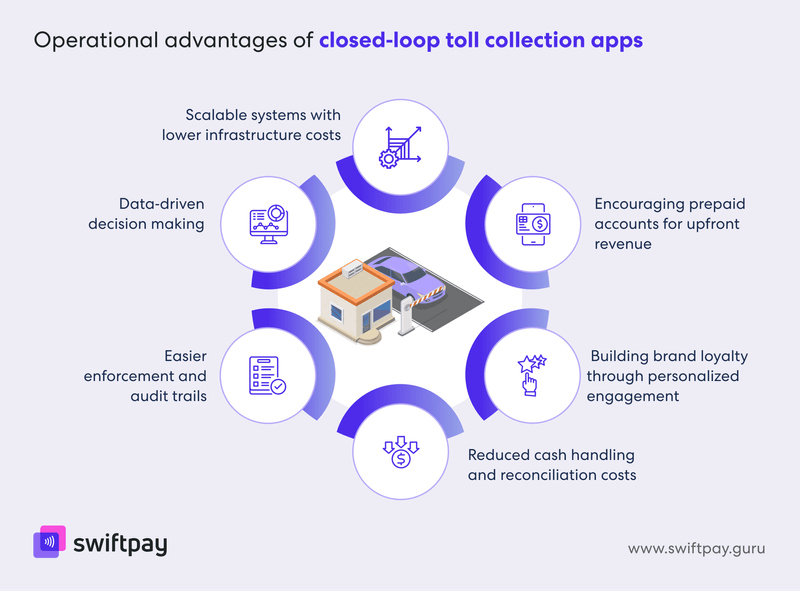

What are some operational benefits of closed-loop automatic toll collection?

Beyond user convenience, closed-loop ETC brings major backend advantages to toll operators like you. Here are some top benefits:

Encouraging prepaid accounts for upfront revenue

By incentivizing users to pre-load funds or purchase travel bundles, you receive capital upfront, which improves your cash flow and reduces collection lags.

Building brand loyalty through personalized engagement

You can use payment data to engage regular users with offers, loyalty points, or tailored subscription plans that make them feel valued.

Reduced cash handling and reconciliation costs

Fewer physical transactions mean lower costs related to cash handling, staff training, and fraud prevention.

Easier enforcement and audit trails

Every transaction is digitally logged, which makes it easier to enforce payments, manage disputes, and conduct transparent audits.

Data-driven decision making

App usage data provides real-time insights into traffic volumes, peak hours, and user behavior. All that allows for smarter infrastructure planning and pricing.

Scalable systems with lower infrastructure costs

App-based toll collection eliminates the need to build or maintain heavy-duty toll plazas, making it easier to scale across regions.

Final thoughts

The toll collection process has transformed globally. And mobile apps play a significant role in it.

These apps are not just a communication tool; they are also a gateway to faster, convenient, and more personalized experiences for road users.

For toll operators like yourself, the rise of mobile apps offers a great opportunity to:

- Reduce costs

- Streamline operations

- Build stronger relationships with commuters.

But to fully realize this potential, the type of system you choose matters.

Closed-loop payment solutions like SwiftPay put you in control.

SwiftPay helps you lower your operational costs, deliver direct engagement, and have the power to customize experiences from end to end.

These systems aren’t just a tech upgrade for toll collection; they’re a strategic advantage. Because speed, transparency, and flexibility are non-negotiables for most people now.

If you’re exploring ways to modernize your toll operations while keeping users at the center, a mobile-first, closed-loop approach is worth serious consideration.