The way people pay for things and the way payments are processed have evolved. And yet, toll collection isn’t as smooth as it should be.

Toll operators like you are constantly dealing with payment disputes, integration headaches, or rising operational costs.

So, it’s clear something isn’t working as well as it should. For many toll operators, the biggest challenges aren’t in the lanes; they’re buried in the systems, processes, and platforms running behind them.

And these challenges don’t just create administrative workload; they slow down toll collections, frustrate users, and impact revenue.

Well, the good news is that most of these issues can be solved with the right mix of technology and strategy.

In this blog, we’ll break down five common toll collection challenges—and show you how to fix each one for better efficiency, accuracy, and user satisfaction.

Let’s get into it.

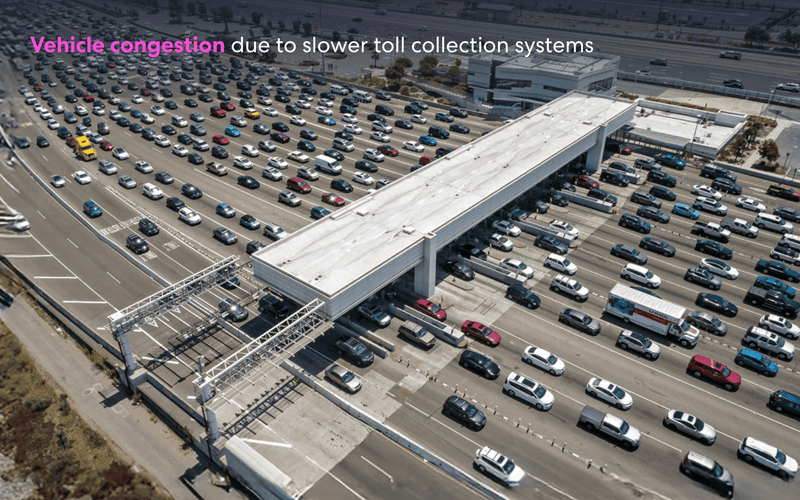

1. Toll collection failures and delays

The Challenge: When a card transaction fails at your tollgate, it’s more than just an inconvenience. Why?

It’s because:

- It slows down every vehicle behind it

- Frustrates drivers

- Creates a pile of work for the back office

Card-side rejections, bank authentication delays, or app timeouts disrupt the flow at scale, especially in high-traffic corridors.

What can be done?

Instead of relying solely on real-time validation from banks, you can consider stored-value or prepaid options that can process transactions instantly. Closed-loop e-wallet apps are ideal for this. These apps enable automatic toll payment and simplify toll collection by allowing users to pay digitally. This eliminates the need for cash or cards and speeds up traffic flow. Payments are automatically deducted from the wallet account when the vehicle passes through the toll gate.

Apart from that, payment systems that work offline can serve as a buffer when connectivity drops or where it’s limited.

A frictionless toll payment experience starts with dependable payment platforms. And that often means moving beyond just cards.

2. High payment processing costs

The Challenge: Every swipe or tap that runs through a payment system (specifically open-loop) carries a cost.

Third-party card networks and acquiring banks take their cut. In an environment where thousands of transactions happen daily, these costs stack up fast.

And they don’t stop at transaction fees; when you don’t have an electronic toll collection system, chargebacks and fraud disputes add another layer of expense as well.

What can be done?

The only way you can eliminate these third-party fees is when you have your own payment ecosystem.

Electronic toll collection (ETC) with closed-loop toll payments—like prepaid wallet apps—can help you bypass third-party processing fees. The more payments that stay within your ecosystem, the more control you have over costs.

Besides, lower costs don’t just protect your profit margins; they help you free up capital to reinvest in:

- Infrastructure upgrades

- Better customer service

- Digital transformation

- Sustainability initiatives

3. Interoperability and integration issues

The Challenge: When road users cross state lines, they shouldn’t have to switch between different apps or accounts. But that’s often what happens when toll systems don’t work together.

Each region, agency, or operator runs its own toll payment system, which leads to a confusing and disconnected experience for highway users.

For operators like you, the result is just as painful:

- Incompatible platforms

- Manual reconciliation

- Difficulty in rolling out unified policies or offers

What can be done?

Full standardization isn’t necessary to solve this. An ETC system that can work with multiple toll authorities, without requiring a complete overhaul, can fix the problem.

Providing a single wallet or account that works across different areas reduces hassle for drivers and makes reporting easier for operators like you.

ETC systems aim to make toll collection and payments simpler, easier to manage, and more appealing to stick with.

4. Administrative and operational burdens

The Challenge: In many areas, toll collection is still manual and cash-based. That’s not efficient and often leads to problems like:

- Mismatched invoices

- Disputes that drag on for weeks

- Account systems that rely too much on manual work

These aren’t rare situations; they’re daily realities for many toll operators like you.

For commercial fleets, the issue is even worse. Disorganized transaction records often lead to billing mistakes and disputes. This creates extra work for administrators and slows down the collection process.

What can be done?

The solution is to bring everything together into one place. That means a unified user dashboard—for users and operators—can centralize toll activity, payment history, and invoicing.

Even better, systems like electronic toll collection that handle everything in real time can make things easier. You can get instant logs, tools to resolve issues directly in the app, and combined billing.

These help you reduce errors and manual work. This means you spend less time chasing down transactions and can focus on improving your toll operations.

Read more: Automatic Toll Collection Made Simple With Mobile Apps

5. Cost and budgeting concerns

The Challenge: Toll rates can vary based on location, time of day, or vehicle type. For individual drivers, this might be a minor hassle.

But for commercial fleets, it’s a major budgeting challenge. Because they are among the ones who make regular journeys across different cities.

Hence, without upfront cost visibility or smart tracking tools, these users struggle to forecast their toll expenses. Plus, that lack of predictability impacts route planning, cost control, and overall trust in the system.

Toll operators like yourself can’t just overlook that.

What can be done?

Predictability builds confidence. Offering prepaid toll plans, capped monthly limits, or subscription-based passes can help most commercial fleets manage costs more effectively.

Closed-loop wallet apps can be coupled with ETC systems to provide real-time spend tracking for highway users and automated usage reports for operators.

When users know what they’re spending—and why—they can plan and budget accordingly.

Final thoughts

Toll collection isn’t just about moving money from highway users to toll authorities like yours. It’s also about creating a system that’s accurate, efficient, and built for real-world use.

The friction points we’ve outlined above are opportunities to reimagine how toll collection works.

You have seen that automated toll collection and electronic toll collection can help you eliminate most toll collection challenges effectively.

And that’s actually the future: The global electronic toll collection market is expected to grow by 8.1% each year from 2024 to 2032.

We at SwiftPay can help toll operators like you streamline your toll collection, cut costs, and simplify user experience, without sacrificing flexibility or control.

Whether it’s reducing processing fees, enabling interoperability, or improving fleet-level reporting, SwiftPay’s closed-loop toll collection system is built to solve the everyday challenges toll networks face.

When you fix the payment experience, you don’t just get faster toll lanes; you get happier users, healthier operations, and a system that’s finally as smooth as the roads it runs on.