As businesses seek deeper customer relationships and streamlined operations, closed-loop cards have evolved from simple gift cards into sophisticated systems that influence purchasing patterns, drive loyalty, and reduce operational costs.

This evolution reflects a fundamental truth: in today's competitive space, how customers pay is just as important as what they buy.

These specialized payment networks do more than just process transactions. They create a controlled environment where every swipe or tap generates insights while building customer connections.

Closed-loop cards are quietly revolutionizing how organizations like yours approach payments. They can transform them from mere transactions into strategic tools for business growth.

Many business owners still don’t know much about closed-loop cards. If you are among those then worry not. Keep reading.

In this blog, you will learn all about closed-loop cards, their core benefits, diverse applications, and the strategic advantage they offer.

Let’s start with the definition.

What are closed-loop cards?

Closed-loop cards are payment tools that operate within a specific business or network. Unlike traditional cards that can be used anywhere, closed-loop cards are tailored for exclusive use at predefined locations or services. Think of them as a VIP pass, but for payments—highly specific and uniquely advantageous.

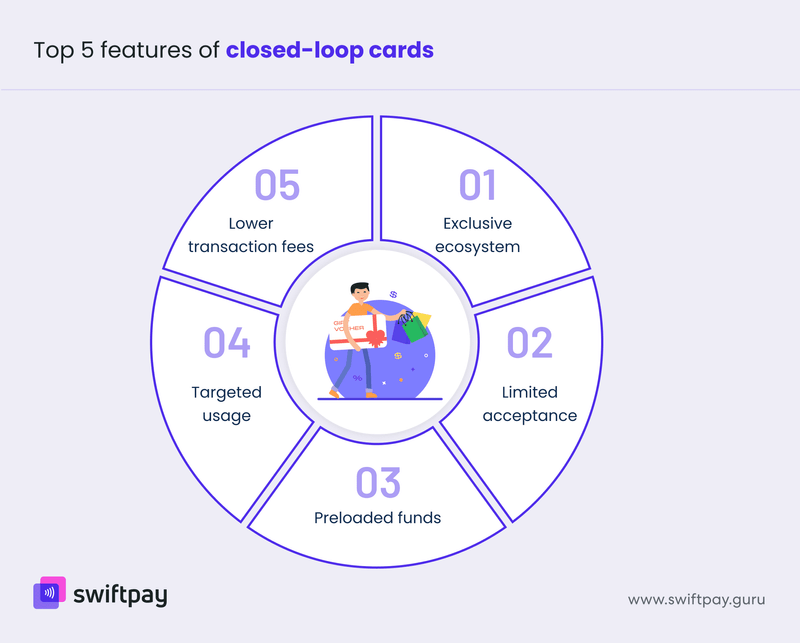

Key features:

- Exclusive ecosystem: Closed-loop cards are not connected to external payment networks like Visa or MasterCard. This exclusivity makes them highly tailored to the business that issues them.

- Exclusive acceptance: These cards only work in specific locations, shops, or for particular services, ensuring focused usage within a brand or network.

- Preloaded funds: Users load a certain amount of money onto the card, which can often be reloaded as per requirement.

- Targeted usage: These cards are designed to promote customer loyalty and facilitate spending within a particular business or network.

- Lower transaction fees: Closed-loop card payment systems typically have lower transaction fees compared to open-loop cards.

Comparison with open-loop cards:

The below table shows the key differences between closed-loop and open-loop cards in many aspects:

| Aspect | Open-Loop Cards | Closed-Loop Cards |

|---|---|---|

| Usage Scope | Can be used across a wide range of businesses, locations, and networks. | Restricted to specific businesses, locations, or ecosystems. |

| Network Dependency | Operates on external payment networks (e.g., Visa, MasterCard). | Independent of external networks, works within a closed ecosystem. |

| Transaction Fees | Includes fees for external network usage and processing. | No external transaction fees as no financial institutes or third-party are involved. |

| Customer Engagement | Limited personalization and rewards. | Tailored rewards and incentives tied to the issuing business. |

| Data Insights | Limited data spread across various merchants and networks. | Unified data, offering actionable insights into customer behavior and preferences. |

| Fraud Risk | Higher exposure to fraud due to multiple parties handling transactions. | Lower fraud risk as transactions remain within a controlled ecosystem. |

| Customization | Standardized & less flexible features. | Highly customizable to align with specific business needs and goals. |

| Control | Businesses have limited control over usage and terms. | Full control over usage, terms, and conditions of the card. |

| Scalability | Suitable for businesses operating across industries and regions. | Best for businesses with controlled, localized, or niche operations. |

| Loyalty Benefits | Generalized loyalty programs with limited business-specific incentives. | Directly tied to business loyalty initiatives to foster customer retention. |

Types of closed-loop cards

Closed-loop cards can be of several types depending on their purpose.

Gift cards

Functionality: Closed-loop gift cards are a popular option for many retailers like you to ensure the funds stay within your store while also rewarding customers for their shopping.

Example: A Starbucks gift card lets recipients pick their favorite drink while ensuring funds cycle back into Starbucks’ revenue.

Employee cards

Functionality: Designed for internal use, these cards streamline employee benefits and expenses.

Example: Many companies offer meal cards to their employees that are usable only at specific cafeterias or partner restaurants.

Store-specific cards

Functionality: Store-specific cards offer exclusive perks, such as discounts or loyalty points, to drive repeat purchases.

Example: A Target REDcard rewards users with exclusive discounts and free shipping on online purchases.

Event or venue-specific cards

Functionality: These cards are designed for exclusive usage during events or within specific venues for food, merchandise, and activities.

Example: Festival wristbands with preloaded funds, eliminating the hassle of carrying cash or cards.

Membership or subscription cards

Functionality: These cards are tied to ongoing memberships or subscriptions to simplify recurring payments and incentivize loyalty for customers.

Example: Costco membership cards grant access to exclusive deals and bulk-buying privileges in any of its stores.

Campus or institutional cards

Functionality: Used in educational institutions for on-campus purchases, such as meals, books, printing, or any other facilities.

Example: Many internationally renowned universities issue campus cards to their students to authorize campus entry/exit and campus-wide payments.

Practical applications of closed-loop cards across industries

Clo0128 sed-loop cards are used across various industries. Let’s see some of its prominent applications:

Retail

Closed-loop cards help retailers like you address challenges like fragmented loyalty programs and inefficient payment systems.

These cards also allow businesses like yours to provide store-specific rewards or discounts. They also help you simplify promotions, refunds, and store credit management.

Hospitality and tourism

In hospitality, closed-loop cards eliminate the hassle of dealing with cash or multiple payment systems.

Hotels, resorts, and tourist destinations use these cards to centralize payments for services like dining, spa treatments, and tours.

Transportation

Public transportation systems often struggle with cash handling and ticketing inefficiencies. Transport operators have countered these problems with closed-loop prepaid cards.

Whether it’s metro systems, buses, or trams, passengers can preload funds onto a card and use it for quick, tap-and-go access.

Events and entertainment

Managing cash payments can be overwhelming and time-consuming at large-scale events or entertainment venues for organizers. Closed-loop cards tackle that by allowing attendees to preload funds for food, drinks, merchandise, or any other event-related purchases.

Apart from that, organizers like you get the advantage of retaining unused funds if customers don’t spend the entire balance, adding to their revenue.

Education

Universities and schools often face challenges with non-unified payment methods for meals, printing, library services, or any other related services. Closed-loop cards for education simplify this by integrating payments into a single system that works across your institution’s facilities.

Moreover, these cards can include access control features, ensuring that only authorized users can utilize campus amenities.

Read more - Closed-Loop Payment Systems for Businesses: Top 5 Use Cases

Benefits of closed-loop cards for businesses

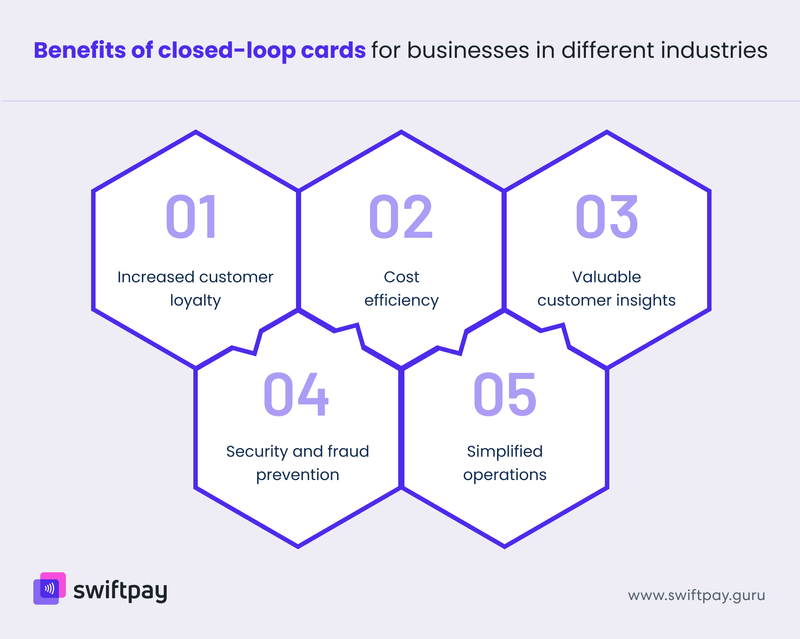

Below are a few key benefits of closed-loop cards for businesses across different industries:

Increased customer loyalty

- Incentivize repeat purchases: Offer your customers store-exclusive discounts or perks.

- Boost Brand Affinity: Create stronger connections through personalized rewards and tailored offers.

Customers appreciate brands that recognize their loyalty and reward them for it. So, it encourages them to return back to your store.

Cost efficiency

- Avoid transaction fees: Closed-loop card payments don’t involve any bank or other third-party network charges; hence, they keep costs lower for your business.

- Streamline payments: Closed-loop cards are a unified payment system, which means faster transactions without any errors.

Cost benefits ensure that businesses like yours retain more of their revenue while also optimizing operations.

Valuable customer insights

- Data-driven decisions: Closed-loop card transactions provide insights into customer preferences and spending habits.

- Targeted marketing: Data from closed-loop card systems can be used to create personalized promotions that resonate with your audience.

Understanding customer behavior helps you refine your strategies and help you serve them better.

Security and fraud prevention

- Reduced fraud risks: The restricted nature of closed-loop cards limits external misuse.

- Controlled transactions: Transactions can only happen within the system that issued the card.

This added level of security builds trust and ensures peace of mind for you and your customers.

Simplified operations

- Faster payments: Quick and efficient transactions help boost customer satisfaction.

- Centralized management: Rewards, promotions, and refunds are easier to handle in the case of closed-loop card payments.

Closed-loop cards help you simplify the payment process so that you can focus on delivering exceptional service.

Conclusion

So, it’s clear now: closed-loop cards are more than a payment method—they're an opportunity. They offer control over transactions, foster loyalty, and provide the kind of customer insights that help businesses like yours grow smartly.

From simplifying business operations and transactions to creating a seamless payment experience in multiple industries, their versatility and benefits are hard to ignore.

Every feature of these cards reflects a deep understanding of what businesses need today: efficiency, security, and ways to build lasting relationships with customers.

Exploring closed-loop systems isn't just about catching up; it's about leading the charge in customer-centric innovation. And we at SwiftPay can help you do that exactly.

It’s time to rethink how payments work within your business and unlock the potential of a payment method designed to keep your customers coming back.

Our experts will guide you on how implementing these cards can streamline operations and help your business thrive among your competitors.