Public transit is the lifeline of modern cities—moving people, connecting communities, and driving economic growth. Whether it's a bustling city metro, a regional bus network, or an underground tube system, the way passengers pay for their journeys can significantly impact the overall travel experience.

Traditional methods like cash payments and open-loop systems have long dominated the scene, but they often fall short when it comes to reliability, cost-efficiency, and inclusivity.

This is where transit operators like you can use closed-loop payments in your automatic fare collection system.

But how does closed-loop automated fare collection make AFC more efficient? That’s exactly what you are going to find out in this blog.

We will explore how these systems redefine AFC by offering unmatched efficiency, accessibility, and control.

Let’s get straight into it without wasting any time.

What is Auto Fare Collection (AFC)?

As the name implies, auto fare collection (AFC in short) is an electronic system specifically designed to automate and streamline fare payment processes for public transportation.

Basically, AFC systems replace traditional cash-based paper tickets with digital and automated methods of paying for transit services. This means commuters don’t have to purchase physical tickets before boarding or while they are traveling. These systems allow them to pay for the transit fare automatically through their bank cards, mobile wallets, or any other integrated devices.

Now that you have understood what AFC means, let’s understand closed-loop payments in AFC.

What are closed-loop payments in AFC?

Any kind of closed-loop payments work in dedicated systems where funds are preloaded onto a card, app, or account that can only be used within a specific network or service—in this case, it’s a transit system.

Unlike open-loop systems that rely on bank-issued cards or digital wallets, closed-loop payment systems operate independently. It provides more control to transport operators like you.

Some key features of closed-loop AFC systems:

-

Transit cards: these cards allow passengers to load funds and use them across a variety of public transport like buses, trains, and subways.

-

App-based payment systems: These are the apps that function as closed-loop wallets specifically designed for transit purposes.

-

Stored value accounts: Systems that integrate a prepaid balance linked to a passenger's unique ID for use exclusively within a transit network.

The need for closed-loop payments in AFC systems

Despite being quite an efficient system for fare collection, automated fare collection falls short in several aspects. Let’s see some common limitations of AFC systems without closed-loop payments:

Inefficient payment processes

- Reliance on cash payments or traditional ticketing systems slows down boarding times, especially during rush hours.

- Manual ticketing often involves the likelihood of errors, which can be one of the main reasons behind passenger dissatisfaction.

Higher costs

- Open-loop systems usually incur higher transaction fees due to payment processing through banks or other external agencies.

- Infrastructure and maintenance costs can shoot up significantly when supporting multiple payment methods.

Security risks

- Open-loop systems are more vulnerable to fraud, especially with card cloning and unauthorized access.

- Tracking and managing payment data becomes complex when integrated with multiple banking networks.

Limited accessibility

- Unbanked or underbanked individuals are excluded from open-loop systems, which restrict many transport access.

- When a certain segment of people doesn’t have access to public transport it also means potential revenue loss for operators.

Without closed-loop solutions, transport systems face operational inefficiencies, higher costs, and a lack of inclusivity, ultimately harming both operators and passengers.

How closed-loop payment systems are key to effective auto fare collection for public transport

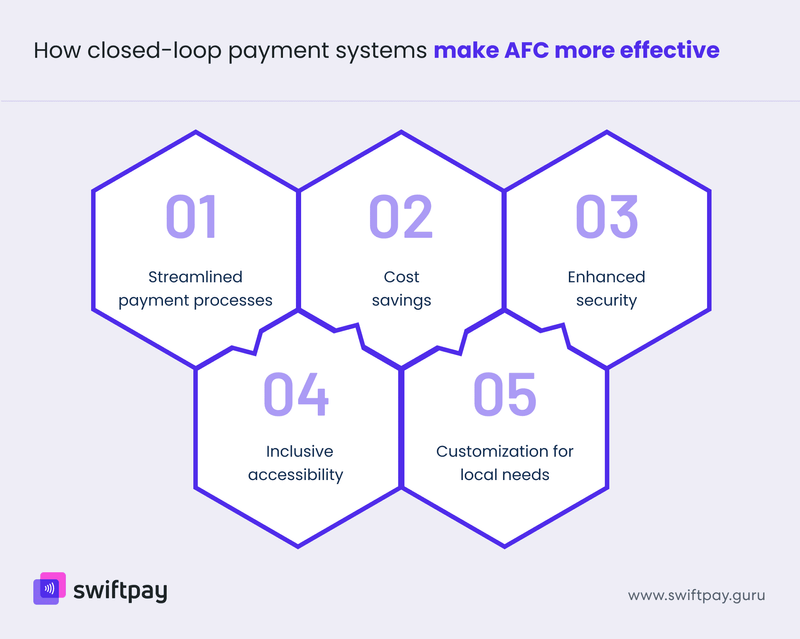

There are multiple facets in which closed-loop payment systems can make AFC more effective:

Streamlined payment processes

- Faster, hassle-free transactions consolidate all fare payments under a single system.

- Passengers can reload cards or apps conveniently, eliminating the need for cash or manual ticketing.

Cost savings

- Closed-loop payment systems eliminate the need of banks for payment processing, which remarkably reduces per-transaction costs.

- Transit operators like you maintain only a single payment network as there are minimal to no equipment and maintenance expenses.

Enhanced security

- Reduced risk of fraud with a controlled system that limits external vulnerabilities.

- Centralized control gives you greater authority over data storage, access, and usage, to minimize fraud risks.

Inclusive accessibility

- Closed-loop systems empower unbanked and underbanked passengers by providing reloadable prepaid cards or app-based wallets.

- Custom fare schemes ensure affordability and accessibility for all demographics.

Customization for local needs

- Transport operators like you can design tailored fare structures to meet the specific demands of a region.

- Promotions and discounts can be incorporated to boost ridership and passenger loyalty.

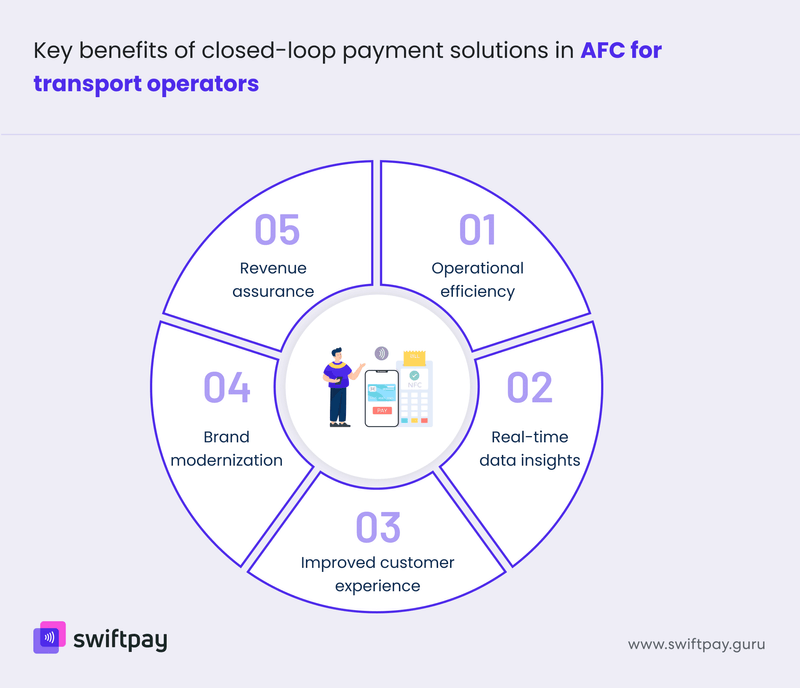

Key benefits of closed-loop payment systems in AFC for transport operators

Closed-loop payment systems offer various benefits for transport operators like you. Let’s explore some of the top benefits of these systems:

Operational efficiency

- Automating fare collection through closed-loop systems speeds up boarding at AFC gates and reduces lines at ticket counters.

- Operators can oversee the entire payment system from a single dashboard, which streamlines operations and maintenance.

Real-time data insights

- Gain actionable insights into passenger patterns, such as peak travel hours and revenue flows.

- Use data to optimize routes, adjust schedules, and allocate resources efficiently.

Improved customer experience

- Faster transactions and seamless travel improve passenger satisfaction.

- Reliable and error-free fare collection systems foster trust and encourage repeat usage.

Brand modernization

- Adopting closed-loop payment for AFC positions operators like you as forward-thinking and tech-savvy.

- Younger and digitally inclined passengers are more likely to choose services offering modern payment solutions.

Revenue assurance

- Centralized payment systems improve tracking and reconciliation. This helps you reduce revenue loss.

- With minimized fraud risks, you can secure consistent and accurate fare collection.

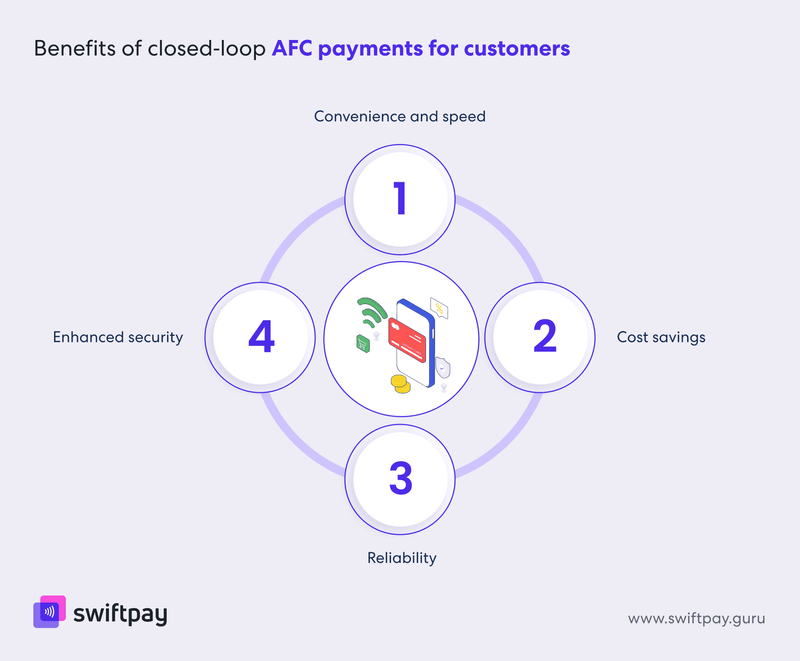

Benefits of closed-loop AFC payments for customers

Closed-loop payment solutions offer ample benefits to your customers as well. Let’s break down some of the top benefits that your customers can enjoy:

Convenience and speed

-

Effortless reloading: Your passengers can quickly add funds to cards or wallets through online platforms or even use auto-reload options.

-

Faster boarding: Closed-loop AFC payments eliminate the need for physical tickets or complex payment methods. This means seamless entry and boarding even during the busiest hours.

Cost savings

-

Exclusive discounts: Your customers gain access to special fares, loyalty rewards, or discounted subscriptions, which makes travel more affordable.

-

No hidden charges: Unlike open-loop systems, there are no additional transaction fees and this ensures your passengers only pay for their journey.

Reliability

-

Minimal transaction failures: Closed-loop AFC systems operate within a controlled network, which significantly reduces errors or failed payments.

-

Consistent performance: Even during high-traffic or offline scenarios, these systems maintain smooth functionality for your passengers.

Enhanced security

-

Reduced fraud risk: Preloaded cards and apps are isolated from external banking networks. Hence, hacking or theft risks are minimized.

-

Controlled dispute management: Centralized account systems enable quick and transparent resolution of fare discrepancies or errors. This helps build trust in the system’s reliability.

Real-world examples and success stories

There are many cities across the globe that use closed-loop AFC systems for public transport. Here we will look at some of the most renowned ones:

London’s Oyster Card

The Oyster card transformed London’s public transport system. It enables passengers to travel seamlessly across buses, trains, and the Tube.

Key takeaway: Streamlined fare payments for various transport modes for faster boarding, and reduced operational costs.

Singapore’s EZ-Link

Singapore’s EZ-Link card system offers contactless payments for buses and trains. Plus, it also integrates with loyalty programs and retail purchases.

Key takeaway: The system highlights how closed-loop solutions can extend beyond transit to everyday spending.

Hong Kong’s Octopus Card

The Octopus card enables cashless payments for public transport as well as retail stores and restaurants.

Key takeaway: Integration of this system with retail stores and restaurants means better convenience for customers and retaining them through versatility.

Read more - Top Practical Applications of Closed-Loop Payment Systems

Conclusion

The role of closed-loop payment solutions cannot be overstated in modernizing public transportation. They do more than just streamline fare collection; they empower transport operators to:

- Cut costs

- Improve operational efficiency

- Offer passengers a seamless and secure travel experience

Besides, these systems also help you address the common AFC challenges like inefficiency, high costs, and limited accessibility.

Closed-loop payment systems are a perfect fit for today’s transit demands. For transport operators like yourself, this is an opportunity to lead the charge in revolutionizing urban mobility without compromising your customers’ trust and satisfaction.

Ready for the upgrade? Learn how SwiftPay–our innovative closed-loop payment solution– can elevate your fare collection system and prepare you for the future of public transport.