When it comes to innovation of any kind, fear often disguises itself as logic.

Just think about it—whenever you want to do anything new or implement something fear kicks in. It usually because of past experiences and beliefs.

It’s also true for business owners like you. What do you think when you see or hear the term “closed-loop payments”? Too limiting. Too costly. Too complicated.

Maybe one of these or all. These sound like reasonable concerns—until you realize they’re rooted in myths, not facts.

The problem is that many decision-makers like yourself write off these systems based on outdated assumptions or secondhand opinions.

But the truth is, closed-loop payments are a go-to strategy for businesses that want more control, better margins, and deeper customer relationships.

To see the potential, however, you have to move past the misconceptions you hold regarding these payment systems.

This blog lays out the most common myths and explains why they shouldn’t shape your payment strategy.

Without any further ado, let’s begin by understanding…

Why is it necessary for businesses to acknowledge myths?

Every new technology faces skepticism in its early stages, which is fine.

But the problem is, over time, these skepticisms can solidify into misinformation. And that’s where myths take root.

As a business owner, if you fail to question myths surrounding your systems and technology, that means you’re missing out on opportunities.

For business owners like you, failing to question these myths doesn’t just mean missed opportunities. It can also lead to:

- Flawed decision-making

- Delayed innovation

- Competitive disadvantage

What happens when businesses don’t acknowledge myths?

Here are several things you may face as a business when you hold on to misconceptions for long:

Innovation gets delayed: When companies believe outdated or inaccurate information, they hesitate to adopt new systems that could improve efficiency or customer experience.

Costs increase over time: Sticking with legacy systems often results in hidden costs—manual processes, third-party fees, customer churn—that could have been avoided.

Competitors gain the edge: While some businesses hesitate, others move forward, offering faster, more convenient payment experiences and gaining market share in the process.

Myth 1: Closed-loop payments are only suitable for certain industries

This myth stems from the early adoption of closed-loop payments in industries like transit and hospitality.

Because those sectors were among the first to implement stored-value cards and branded payment systems, many assume the technology is niche or industry-specific.

The perception lingers that unless a business operates in a tightly controlled environment—let’s say a stadium, amusement park, or train network—closed-loop payments aren’t worth exploring.

Why it’s not true

In reality, closed-loop payments are industry-agnostic, meaning they are not just made for a few specific industries. Instead, they can be tailored for as per business needs in many different industries.

Retailers, restaurants, cafes, parking operators, fuel stations, corporate organizations, and even educational institutes can implement them.

Industry doesn’t really matter, to be honest. What matters is it’s whether your business wants more control over your payment ecosystem.

Closed-loop payment systems work especially well in environments where customer return rates are high and convenience matters. For example:

-

Quick service restaurants and cafes can use closed-loop systems to let customers pay via branded e-wallet apps or top-up cards to reduce wait times and easily collect and spend rewards.

-

Many retail brands issue closed loop wallets or loyalty-integrated payment apps to encourage repeat visits while minimizing transaction fees.

-

Events and entertainment venues also use NFC and RFID bands for food and merchandise purchases within the venue for a frictionless payment experience.

Myth 2: Closed-loop payment systems are not profitable

This belief often comes from comparing closed-loop payment networks to traditional card payments.

Businesses like yours assume that building and managing a branded payment system costs more than simply outsourcing payments to third-party processors or card networks.

Besides, many believe that adoption might be low, and profitability seems questionable. No doubt, it’s a legit concern, but the reality is different.

Why it’s not true

What’s often overlooked is the long-term economics. Closed-loop payments significantly reduce per-transaction fees, allow businesses like yours to bypass intermediaries, and offer direct access to customer behavior data.

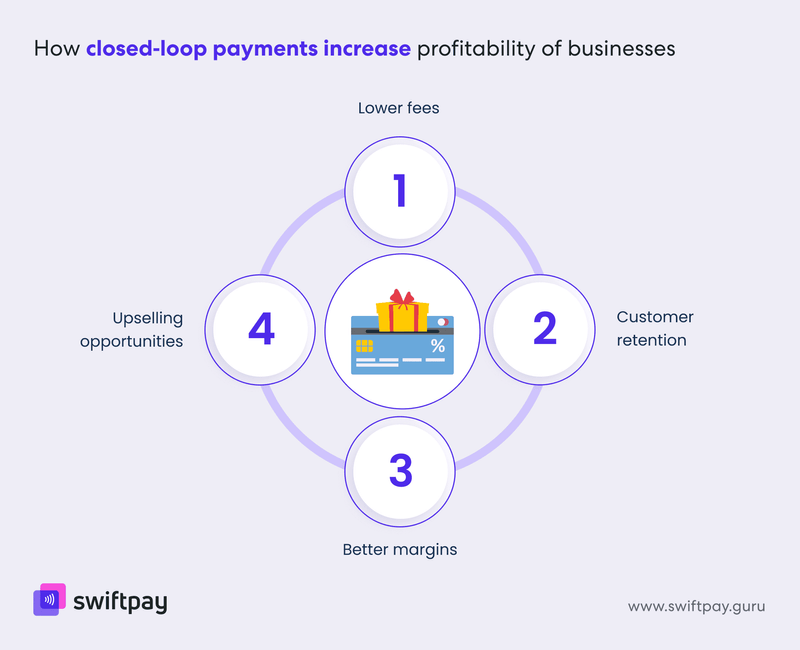

Here’s what makes them profitable:

- Lower fees: You don’t have to pay Visa, Mastercard, Amex, etc., a percentage of every transaction. These small fees may not seem like much, but when you consider the volume of transactions, it certainly makes a difference.

- Customer retention: Closed-loop payments are often bundled with some kind of loyalty rewards to encourage repeat use. This increases average customer lifetime value.

- Upselling opportunities: When you control the payment environment, you can introduce exclusive offers, top-up bonuses, and membership perks at checkout.

- Better margins: Integrating promotions and offers into your own system allows you to save on marketing and avoid relying on external platforms.

Profitability isn’t just about direct revenue; it’s also about:

- Customer retention

- Operational savings

- Data ownership.

Closed-loop payments give businesses like yours the power to influence all three.

Myth 3: Closed-loop systems are less secure

Some businesses worry that handling payments directly or storing customer balances introduces more risk.

Compared to using established third-party gateways or open-loop platforms, closed-loop systems may seem like a security liability.

Why it’s not true

In reality, closed-loop prepaid cards and e-wallets are built with modern security protocols.

The difference is in who controls the infrastructure, not how secure it is. Here’s how these systems make payments secure:

- Data encryption is standard across reputable closed-loop platforms. It ensures that transactions and balances are protected.

- Tokenization can be used to mask sensitive information, which makes it useless to attackers even if intercepted.

- Usage controls are stronger in the case of closed-loop networks. That means businesses like yours can restrict how and where their funds are spent, which limits misuse or fraud.

Apart from that, by operating in a closed ecosystem, you can also protect yourself from vulnerabilities in external payment networks.

Most reliable companies like SwiftPay offer compliance with PCI DSS, integrate biometric authentication where needed, and deliver real-time fraud monitoring tools. All of that raises the security bar for payments.

Myth 4: Closed-loop systems are too complex to implement

This myth is one of the most persistent and also the most misleading.

Business owners like you imagine months of development, backend integration headaches, and massive training efforts just to launch a basic system. Compared to simply accepting existing payment methods, closed-loop payments feel intimidating.

Why it’s not true

Closed-loop payment systems don’t need to be built from scratch. These systems are usually white-label, which means they can be plugged into your existing POS setups, apps, or customer portals. No need for a massive IT team or months-long rollout.

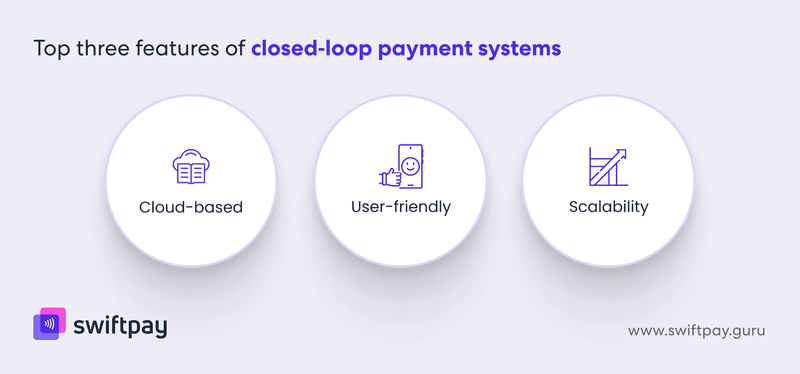

Here’s what you can expect from the best closed-loop payment systems:

- Cloud-based: No complex hardware installation, and updates happen remotely.

- User-friendly: Dashboards and customer interfaces are designed with simplicity in mind.

- Scalable: You can start with a basic payment wallet and expand into loyalty cards, real-time analytics, or QR-based payments as needed.

Implementation timelines can be as short as a few weeks, especially when you work with a seasoned provider. The key is choosing a partner that understands both the technology and the use case.

Myth 5: Closed-loop payments lack real-time reporting

This myth is rooted in outdated systems where data syncing was slow or non-existent.

Businesses like yours worry that if they can’t track payments or balances in real time, they’ll lose visibility into operations

What’s even worse is that you won’t be able to respond to customer issues quickly.

Why it’s not true

Modern closed-loop payment solutions offer real-time dashboards, automated reporting, and integration with CRMs or business intelligence tools. That means you can monitor things like:

- Top-up and usage patterns

- Customer activity

- Balance liability across user segments

- Redemptions, refunds, and loyalty point movements

Real-time data doesn’t just improve visibility; it drives decision-making. It gives you the freedom to adjust offers based on usage trends, identify inactive users, and even forecast revenue more accurately.

In fact, many closed-loop payment systems give you more insight than traditional processors, where data is fragmented or delayed by intermediaries.

Conclusion: It’s time to move beyond the myths

Closed-loop payment systems are among the best ways to accept payments for small businesses.

Besides, these systems are a proven way to build brand loyalty, control your payment ecosystem, and improve operational efficiency.

What once sounded niche or complex is gradually getting mainstream, secure, and profitable.

As mentioned before, if you continue to believe the myths you’ll risk missing out on key advantages, you operational costs will increase over time, and your competitors will get ahead.

At SwiftPay, we help businesses like yours implement closed-loop payment solutions tailored to your needs without any complexity.

Our platform supports branded e-wallets, seamless integrations, real-time reporting, and secure user experiences from day one.

Don’t let outdated assumptions shape your decisions. Closed-loop payments can reshape how business is done.

If you're ready to rethink payments and invest in long-term customer loyalty, we're here to guide you. Get in touch with SwiftPay to explore how you can get started—before your competitors do.