Payment systems often operate in the background of business operations, yet they hold an outsized influence on customer experiences and profitability.

For many businesses, traditional payment methods like bank cards and third-party processors come with hidden challenges: high fees that chip away at margins, rigid systems that lack flexibility, and a disconnect that limits meaningful customer engagement.

To overcome such challenges, businesses across industries need a different payment solution. This is where closed-loop payment networks help businesses like yours and transform the way you approach payments.

Instead of relying on external processors that dilute profits and limit control, these systems give you the command to handle transactions with an in-house payment processing ecosystem. They don’t just process transactions—they transform them into strategic assets.

In this blog, we’ll explore:

- How closed-loop payment networks work and what sets them apart.

- The benefits they offer for businesses and customers alike.

- Key features that make them an essential tool for fostering engagement and loyalty.

Let’s begin.

What are closed-loop payment networks?

To fully grasp the value of closed-loop payment networks, it’s important to first understand what sets them apart from other payment systems.

Definition and key characteristics

Closed-loop payment networks are systems where payments occur within a controlled ecosystem, specifically between designated parties that is your business and your customers.

Unlike traditional payment systems (like bank cards) that are universally accepted, closed-loop payments are exclusive to the business or network that issues them. For example, a retailer can issue branded payment cards or create an e-wallet app that customers can use solely within their store or platform.

The defining feature of closed-loop payments is that businesses like yours can act as both the issuer and acceptor of payments. This control means you don’t have to rely on third-party intermediaries.

Besides, these systems often integrate seamlessly with customer loyalty programs, which makes them a powerful tool for strengthening customer relationships and retention. To understand the benefits of closed-loop payment networks it is important that first you understand its working.

How closed-loop payment networks work

The mechanics of closed-loop payments follow a straightforward but powerful process:

-

Issuance: Your business creates the payment medium – physical cards, e-wallets, or account-based systems that exist entirely within your ecosystem.

-

Funding: Customers load value(amount) into their accounts through various methods – direct deposits, transfers from bank accounts, or converting cash at point-of-sale locations. (Or it can be pre-loaded as well in the case of gift cards or loyalty cards. It doesn’t always have to be some currency, you can also load reward points as well.)

-

Usage: Customers make purchases exclusively within your network of locations or services, using specialized payment instruments or apps that communicate directly with your payment infrastructure.

-

Settlement: Transactions are processed internally without routing through external networks, which eliminates intermediary fees and significantly reduces processing time.

-

Reporting: Each transaction generates valuable customer data that flows directly into your business intelligence systems, creating a continuous feedback loop for optimization.

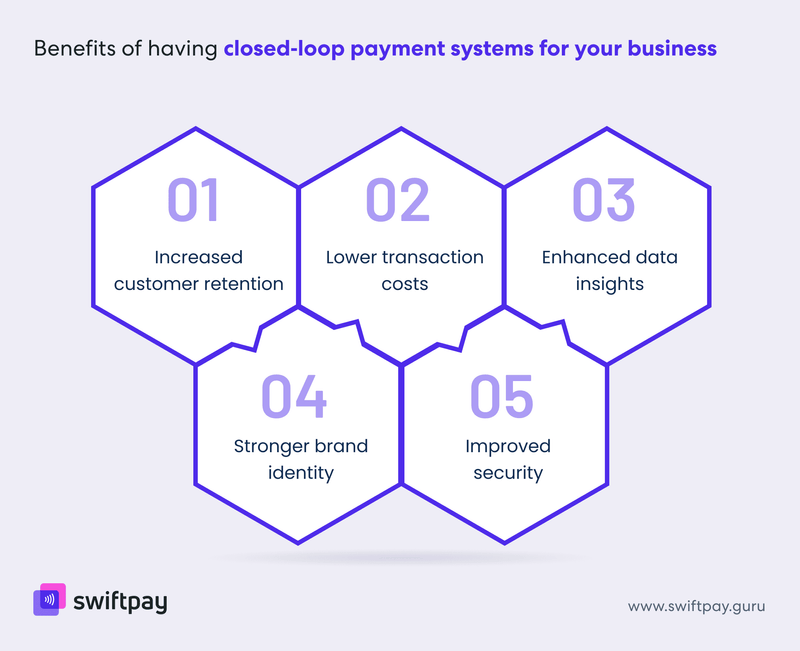

Benefits of closed-loop payment systems for businesses

Let’s explore the wide range of benefits that businesses can expect with closed-loop payment networks:

Increased customer retention

Closed-loop cards naturally encourage your customers to return to your business. Gift card programs represent one of the simplest yet most effective implementations of this principle.

When customers receive or purchase gift cards for your business, they're essentially committed to a future visit.

For example, salons and spa businesses can create prepaid service packages that encourage regular appointments and long-term customer relationships.

Lower transaction costs

No business is immune from payment processing fees. A 2023 CNBC report said that many small businesses face a tough choice: raise prices to cover the processing fees or accept lower profit margins.

Closed-loop cards or wallets can substantially reduce these costs because they work without third-party processors.

Let’s say if you operate a cafe, then you can offer wallet app-based payment options that save on processing fees while accelerating checkout times during morning rushes.

Enhanced data insights

Traditional payment processors provide limited transaction data. Closed-loop networks, however, allow businesses like yours to capture comprehensive purchasing patterns that can transform your marketing and operations.

Grocery stores usually see a higher number of transactions as compared to other retail stores. So businesses like that can analyze basket compositions to create more effective promotions based on actual purchasing patterns.

In the case of hotels, business owners can understand guest spending across different services (dining, spa, activities) to develop more appealing packages.

Stronger brand identity

A branded closed-loop payment system strengthens your company’s identity at every interaction. Whether it’s a store-specific gift card with your logo or an e-wallet app for your business, these tools keep your brand front and center.

This consistent exposure builds trust and familiarity, which helps in making your business more memorable. Besides, the customers who use your customized payment tools are likely to develop a stronger emotional connection to your brand.

Improved security

Closed-loop systems provide enhanced security compared to traditional payment methods, protecting both your business and your customers.

Unlike open-loop systems that process data through multiple third parties, payments done through closed-loop systems are managed and approved internally. This offers greater control over sensitive customer information.

All the top-notch closed-loop payment systems are equipped with tokenization or encryption technologies to ensure compliance with industry standards like PCI DSS. This added layer of security provides reassurance to customers that their information is safe.

How closed-loop payments transform customer experience

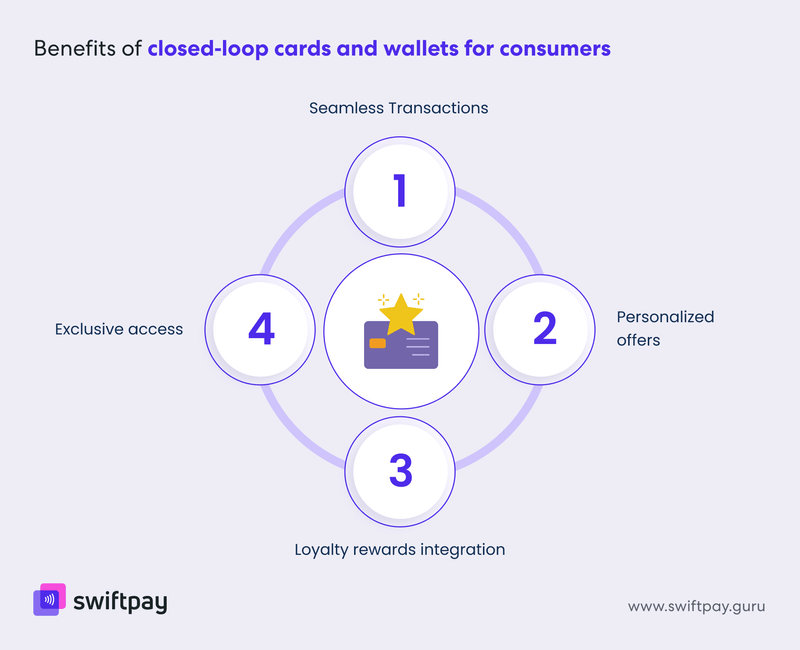

Closed-loop payment systems redefine how customers interact with your business, elevating their experience at every touchpoint. Below are several advantages that your customers can expect:

Seamless Transactions

Closed-loop payment networks create frictionless transactions to simplify the customer experience.

You can eliminate friction points that frustrate your customers during traditional payment experiences by controlling the entire payment process.

Sports venues, for instance, can implement tap-to-pay wristbands that eliminate concession lines and allow fans to enjoy more of the event instead of waiting to pay. Similarly, transit operators can provide closed-loop payment cards that work across buses, trains, and parking facilities without requiring separate transactions.

Personalized offers

When payment systems connect directly to customer profiles, you can deliver truly relevant offers based on individual preferences and history.

This can be highly effective in any type of store. Bookstore owners, for example, can recognize customer genre preferences and offer personalized discounts on new releases in those categories, or a clothing retailer can recognize seasonal buying patterns and alert customers to new arrivals that match their established style preferences.

Loyalty rewards integration

When payment and loyalty systems are tied together, reward experiences become effortless for your customers.

This means your customers can automatically earn points with each purchase and can use those points during future transactions without extra steps. Such effortless reward redemption increases participation in loyalty programs and keeps your customers coming back for more.

Read more - Guide for Building Brand Loyalty with Closed-Loop Wallets

Exclusive access

Customers who use your closed-loop prepaid card or wallet get experiences and offers that are unavailable to other customers. This creates a sense of exclusivity, which drives more customers to adopt these payment methods.

Again this can be done by businesses across different industries. Consider this, a concert venue can offer closed-loop NFC card users early access to seating or exclusive merchandise not available to general ticket holders. Further, retailers can create "member pricing" available only to closed-loop wallet users to create immediate perceived value for participation.

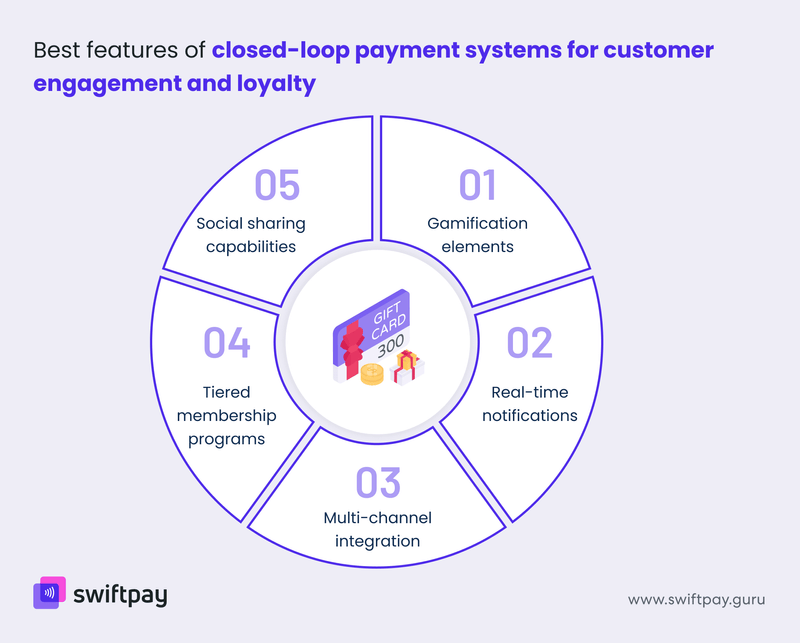

Key features of closed-loop payment networks for better engagement and loyalty

To drive deeper customer engagement and long-term loyalty, closed-loop payment networks come packed with features that can level up customer engagement and loyalty.

Gamification elements

When you incorporate game mechanics into your payment system, you transform ordinary transactions into engaging experiences.

Achievements, challenges, and friendly competition create powerful behavioral hooks that keep your customers coming back.

Your customers don't just want to save money—they want to feel accomplished. Gamification satisfies this psychological need while simultaneously driving specific purchasing behaviors that benefit your business.

Real-time notifications

Sending timely and relevant alerts directly to your customers' devices through your closed-loop wallet app will keep reminding your customers about your brand.

Unlike generic marketing messages, payment-linked notifications feel personally relevant and service-oriented.

These real-time touchpoints create natural re-engagement opportunities without intrusiveness—they offer genuinely helpful communications tied to accounts your customers already value.

Multi-channel integration

Closed-loop payment platforms allow you to connect your store’s physical and digital presence through a unified payment experience across all customer touchpoints. This seamless integration eliminates frustration points and provides the payment convenience that your customers want.

This integration doesn't just improve customer experience—it gives you complete visibility into the customer journey, regardless of which channels they use to engage with your brand.

Tiered membership programs

You can structure your closed-loop payment system with progressively valuable membership levels that reward your best customers while motivating others to increase engagement.

This approach naturally segments your customer base. You'll identify your high-value customers, understand what drives their loyalty, and learn how to cultivate more customers like them—all through natural payment behaviors rather than separate customer loyalty programs.

Social sharing capabilities

Amplify customer relationships through social elements that transform individual customers into brand advocates. When you reward the customers who share or recommend your business, you extend your reach through trusted peer networks.

These social features generate authentic endorsements from real customers that carry significantly more credibility than traditional advertising, which is great for organically extending your brand reach.

Final thoughts

The way businesses manage payments has changed dramatically mostly because of customers’ expectations. They now want fast, convenient, secure, and personalized experiences. Closed-loop payment solutions tick all those boxes. These systems provide unmatched control, enhanced security, and unique branding opportunities. They are redefining how businesses like yours engage with their customers during every transaction.

Overall, they empower businesses to differentiate themselves and thrive in competitive markets.

With SwiftPay, adopting a closed-loop payment network has never been easier.

Our solution is designed to cater to the unique needs of businesses across industries. It empowers you to:

- Build customer loyalty

- Streamline transactions

- Unlock the full potential of payment data.

From issuing branded gift cards to creating exclusive loyalty programs in a wallet app, SwiftPay provides the tools you need to maximize your payment ecosystem for your business.

Ready to take the next step? Schedule a consultation with us today to see how SwiftPay can elevate your business and turn your payments into a powerful driver of business growth