Running a restaurant is as much about managing payments as it is about serving great food. From slow payment systems that frustrate customers to high transaction fees that eat into your profits, payment challenges can quietly erode the efficiency and profitability of your business.

But what if there was a way to take control of these pain points—on your terms?

Yes, closed-loop payment systems offer restaurant owners like you a smarter and more streamlined approach to handling transactions.

Unlike traditional payment methods that rely on third-party providers, these systems operate within a controlled network, giving you full ownership of the process.

This results in faster payment processing, lower costs, happier customers, and even insights into purchasing behavior that can help you make smarter business decisions.

In this blog, we’ll explore how closed-loop contactless payments for restaurants help you eliminate common payment hurdles, and how it could be the key to simplifying your restaurant operations while boosting your profitability.

Let’s begin.

The impact of payment experience on customer satisfaction and retention

A smooth and hassle-free payment experience is a critical factor in customer satisfaction. A slow payment process can leave a bad final impression, and it may even reduce the likelihood of repeat visits.

A frictionless payment process, on the other hand, encourages loyalty and positive word-of-mouth.

Customers now expect digital, contactless (tap-and-go) payment options that mirror the convenience of mobile wallets and online transactions.

It doesn’t matter whether your customers are dining in, ordering takeout, or using your restaurant’s app, speed and ease are non-negotiable.

Closed-loop payment systems are designed keeping in mind these customer expectations. Hence, these systems ensure that transactions are quick, seamless, and integrated with rewards—boosting retention and encouraging repeat business.

Comparing closed-loop vs. open-loop payment systems in restaurants

The below table lists several distinct differences between closed-loop and open-loop payment systems:

| Feature | Open-Loop Payment System | Closed-Loop Payment System |

|---|---|---|

| Transaction Speed | Dependent on third-party processing times | Instant, stored-value transactions |

| Loyalty Integration | Requires separate apps or manual tracking | Built-in rewards, seamless tracking |

| Processing Fees | Higher fees due to card network charges | Lower fees, no external networks involved |

| Customer Data Access | Limited access, controlled by third parties | Full visibility into spending behavior |

| Branding & Engagement | Shared branding with banks/payment providers | Keeps customers within the restaurant ecosystem |

Common payment challenges faced by restaurant owners

Even the best-run restaurants struggle with payment inefficiencies. Following are some common payment challenges that impact revenue, customer satisfaction, and overall business operations:

Slow and inefficient payment processes

- Traditional card payments and cash handling create bottlenecks, especially during peak hours.

- For many customers inserting or swiping cards and confirming payment with a PIN is a hassle.

Difficulty managing loyalty programs

- Many restaurants rely on punch cards or dedicated apps for rewards and loyalty, which leads to low participation rates.

- Customers often forget to redeem points and that reduces engagement and effectiveness of your loyalty program.

Fragmented payment methods across multiple vendors

- Restaurant businesses like yours juggle different POS systems, third-party delivery apps, and payment processors.

- High transaction fees and reconciliation complexities add to operational inefficiencies.

Limited customer data and insights

- Traditional payment systems provide little to no data on customer spending habits.

- Limited data means restaurant owners like you miss out on opportunities for targeted promotions and personalized marketing.

Inconsistent branding and engagement

- Third-party payment providers control customer interactions, which limits your brand presence.

- Restaurants like yours also struggle to engage customers directly and build long-term loyalty due to limited and inconsistent branding.

Read more - 10 Things to Know about Closed-Loop Payment System For Restaurants

How closed-loop payments solve common payment challenges in restaurants

Payment issues aren’t just annoying; they eat into your time, money, and customer satisfaction. Closed-loop contactless payment systems can easily tackle the common payment issues you face. Here’s how:

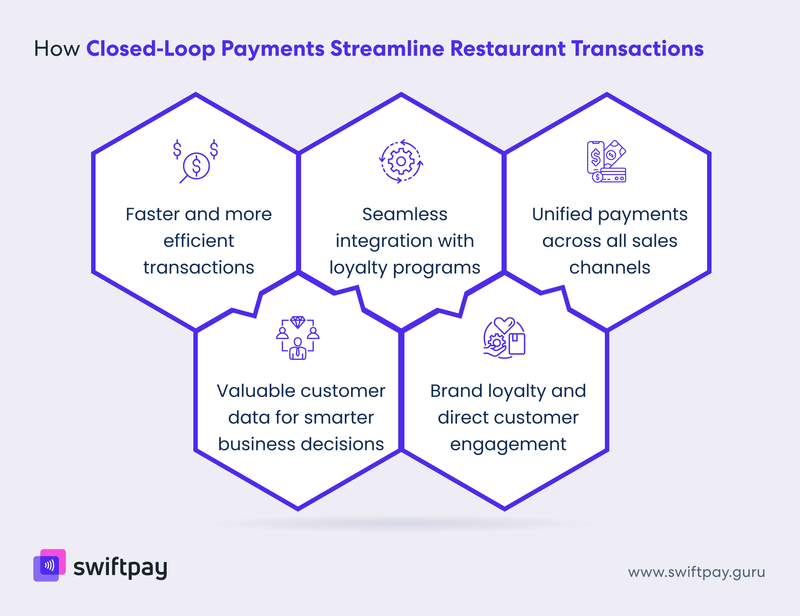

Faster and more efficient transactions

One of the biggest headaches for customers in any restaurant is waiting, especially if it’s a fast-food chain or a cafe. Whether it’s customers tapping their fingers at the counter or your staff scrambling to process payments during a rush.

Closed-loop payments cut through the chaos by letting your customers pay instantly using stored-value accounts (on smartphone apps) or branded payment cards. Your customers don’t have to worry about bringing cash or bank cards, and you don’t have to worry about dealing with external processors.

This isn’t just about speed—it’s about simplicity as well. When transactions are faster, lines move quicker, tables turn over sooner, and customers leave happier. Plus, relying less on third-party systems means fewer technical hiccups and lower costs. It’s a win-win for your business and your customers.

Seamless integration with loyalty programs

Loyalty programs are great in theory and they are critical for customer retention, but when payments and rewards operate on separate platforms, engagement drops.

A closed-loop payment system combines the two, automatically tracking and applying rewards whenever a customer pays. This removes friction, encourages repeat visits, and ensures that your customers see the value in using your restaurant’s own payment method.

Apart from that, closed-loop wallets outperform mainstream payment solutions like Apple Pay or Google Pay when it comes to customer loyalty. Your branded digital wallet keeps your customers engaged within your brand’s ecosystem. Why? It’s because your customers can receive personalized offers, tiered rewards, and exclusive discounts through your closed-loop wallet app, which will drive engagement and long-term loyalty.

Unified payments across all sales channels

Many restaurants operate across multiple touchpoints—dine-in, online ordering, mobile apps, and even third-party delivery services. Managing different payment solutions for each of these channels is inefficient and costly.

A closed-loop payment system simplifies things by processing all transactions under one roof. It ensures that your customers have a consistent experience regardless of what channel they are using to order.

When you have a single system handling all transactions, reconciliation becomes easier, and you gain better control over your revenue streams.

Unlocking valuable customer data for smarter business decisions

Closed-loop payment systems’ ability to capture detailed customer insights is like the ace of spades for restaurant owners like you. These systems allow you to track things like:

- Purchase frequency

- Preferred menu items

- Peak dining times

There’s a wealth of data to work with. Want to know which menu item sells best on weekends? Or when your slowest hours are? The answers are right there.

This kind of insight lets you craft smarter strategies. You can send personalized offers to your regulars, tweak your menu based on trends, or schedule staff more efficiently.

When you understand your customers better, you can serve them better—and that’s how you build loyalty.

Strengthening brand loyalty and direct customer engagement

Finally, there’s the magic of keeping customers within your ecosystem. When people use your branded payment options, they’re not just paying—they’re engaging with your business.

You can reward them with exclusive promotions, upsell new items, or surprise them with special deals. Closed-loop e-wallet apps allow you to communicate directly with customers through in-app messaging, push notifications, and exclusive promotions.

This goes beyond completing transactions. You are forming a relationship with your customers. And when customers feel valued, they stick around.

Additional benefits of closed-loop payment systems

Apart from solving immediate payment challenges, closed-loop payments in restaurants provide strategic advantages that drive long-term business success.

Enhanced operational efficiency

- Less manual work: You don’t need to count cash, reconcile receipts, or chase errors. Closed-loop systems automate these processes, freeing up your team to focus on what really matters—serving your customers.

- Real-time tracking: It allows you to monitor sales and inventory as they happen. This helps you restock smartly, avoid shortages, and spot trends before they become problems.

Increased customer retention

- Seamless rewards: When payments and loyalty programs are tied together, customers are more likely to return. Easy rewards redemption keeps them coming back for more.

- Targeted re-engagement: Use customer data to identify customers before they churn and win them back with personalized offers. A little effort goes a long way in building loyalty.

Improved cash flow management

- Faster access to funds: You don’t have to wait for days for banks to settle transactions. With closed-loop systems, funds are available quickly, which gives you more financial freedom and control.

- Predictable revenue: By processing all payments through one system, you gain a clearer picture of your income, making it easier to plan and invest confidently to optimize your business further.

Conclusion: Why restaurant owners should invest in a closed-loop payment system

Restaurant owners like you shouldn’t overlook the impact of payment experiences.

A slow and fragmented payment system not only frustrates customers but also affects your overall revenue.

Closed-loop payment systems offer a smarter way to manage transactions, enhance loyalty programs, and gain valuable customer insights—all while reducing costs.

But they don’t stop there. These systems also provide tools to streamline your restaurant’s operations, engage customers, and make smarter business decisions.

What you need to remember is this: closed-loop payment systems for restaurants aren’t just about processing payments; they’re strategic tools that help you take control of your business and thrive among your competitors.

That’s where SwiftPay comes in. It’s built specifically for restaurants like yours, with features that align perfectly with the benefits we’ve covered:

- Faster Transactions: Speed up checkouts and reduce reliance on cash or third-party processors.

- Built-in Loyalty: Automatically reward customers and encourage repeat visits without extra effort.

- Real-Time Data: Track sales, inventory, and customer trends to stay ahead of the curve.

If you’re ready to simplify your operations, boost customer satisfaction, and grow your business, it’s time to consider a closed-loop payment system.

Make the switch today and see how SwiftPay can help you elevate your restaurant to the next level.

FAQs

Yes, most closed-loop systems are designed to integrate seamlessly with a restaurant’s existing POS system. They can work alongside traditional card payments, mobile wallets, and cash transactions. This allows restaurant owners to offer more payment flexibility while reaping the benefits of a dedicated closed-loop solution.

Closed-loop systems link payments with rewards, automatically tracking and redeeming loyalty points within the same platform. Customers don’t need separate loyalty cards or apps, making it more convenient for them to earn and use rewards. This seamless experience encourages repeat visits and long-term engagement.

Yes, closed-loop systems offer enhanced security compared to cash or open-loop payments. Since transactions occur within a controlled network, the risk of chargebacks, unauthorized transactions, and third-party fraud is significantly reduced. Additionally, if a customer’s account is compromised, funds can be frozen or transferred to a new account instantly.