Are you struggling to keep your customers engaged and loyal to your business? Apart from your competitors luring them away what other reasons could be behind this?

Well, it could be your generic rewards programs, underutilized customer data, or your store could be missing a unique offering of its own.

When facing situations like that, businesses like yours must rethink the question: What makes a customer return to a brand?

It’s certainly more than excellent products or customer service—it’s also the connection they feel with your business.

Multiple studies have shown that loyal customers stay longer and they also spend more. Besides, the market is crowded and consumers aren’t short of options.

That’s why businesses like yours need a solution that allows you to integrate loyalty programs with payments.

This is where closed-loop payment systems come in. These systems act as a bridge to enable businesses like yours to create personalized and seamless experiences that keep customers coming back.

Curious to know how these systems make that happen? Bingo! You’re at the right place.

In this blog, we’ll explore:

- Why customer engagement and loyalty are more important than ever

- How closed-loop payment systems function

- How they can transform your approach to customer retention.

Let’s dive into the details.

The importance of customer engagement and loyalty

It’s crucial to understand the importance of customer engagement and loyalty for business owners like you in order to understand their relationship with closed-loop payments.

Why engagement and loyalty matter for businesses

When a customer walks into your store for the first time, they are not there only to buy your products. They are deciding whether your business resonates with their expectations and emotions.

That’s why customer engagement and loyalty are so much more than completed transactions; they are also about earning a place in your customers’ hearts.

When loyalty is nurtured, customers don’t just return—they promote your brand as if it were their own. Why? Because we humans are wired for connection.

We value consistency, trust, and recognition. Your loyal customers don’t see you as just another business; they see you as part of their community. And every business strives for that.

There’s no shortage of fleeting deals and discounts that businesses offer, what truly sets your business apart is how you make customers feel. This is why genuine relationships outlast temporary price and sale wars; that is what gives you a competitive edge that no algorithm can replicate.

Common challenges businesses face in maintaining Loyalty

Here’s the paradox: technology has made it easier to connect with customers, but it has also raised the stakes.

People now crave seamless shopping experiences. Still, many businesses fall into the trap of viewing loyalty as a transaction rather than an emotional bond.

What businesses like yours should realize is this: your customers have been conditioned by instant gratification—think same-day delivery and one-click checkouts.

Any friction in their journey, whether through outdated systems or impersonal interactions, becomes a deal-breaker. Even worse is the relentless price wars that erode your margins and shift the focus from relationships to bargains.

But here’s the deeper challenge: loyalty isn’t something you can demand—it’s something you earn over time. Building loyalty requires:

- Consistent effort

- Authenticity

- An understanding of what makes your customers tick

Businesses that fail to recognize this often find themselves chasing customers who have already moved on.

To overcome such challenges closed-loop payments are what businesses like yours can adopt.

Understanding closed-loop payment systems

Think of closed-loop payment systems like a private transport service for an organization where only members or staff of that organization can use it.

Similarly, with closed-loop payment options, your customers get exclusive access to your business's payment ecosystem.

Just like the staff or members can’t use the organization’s transport to go anywhere else except their own office or location, your customers can't use your closed-loop cards or wallet at other businesses.

When businesses implement closed-loop payment solutions, they're essentially building their own financial clubhouse. Store apps, gift cards, and prepaid cards work like membership cards—they're valuable only within that specific business.

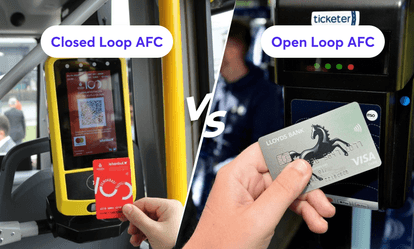

How they differ from open-loop payment systems

Now, regular credit and debit cards are like public transport. They’re generally accessible and customers can use them to go to different places instead of just their workplace. That's what makes them "open-loop."

But closed-loop systems trade this go-anywhere flexibility for something more valuable: a direct connection between you and your customers.

To consider another aspect, while open-loop payments pass through many hands (banks, credit card companies, payment processors), closed-loop keeps everything in-house.

This setup gives you full visibility of what your customers love when they shop, and how they spend - insights that would otherwise get lost in the noise of general payment data. Plus, you can add special touches to the payment experience that regular bank cards simply can't match.

How closed-loop payments improve customer loyalty

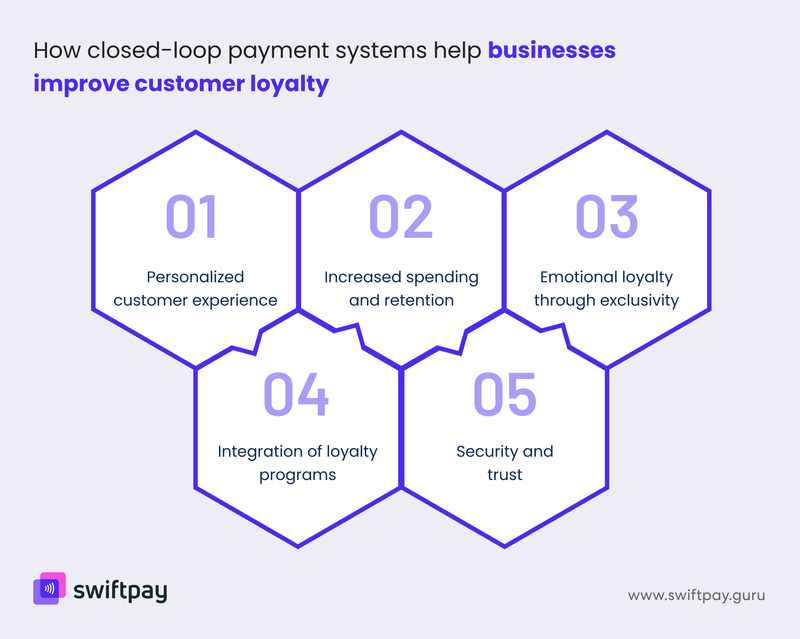

Closed-loop payment systems significantly enhance customer loyalty through various mechanisms that create a more engaging and rewarding shopping experience. Here are the primary ways these systems contribute to customer loyalty:

Personalized customer experience

Your closed-loop payment platform becomes a window into customer preferences. You'll be able to get insights on:

- What they buy

- When they buy

- How often they return

- Which promotions resonate with them

These insights let you craft personalized offers that feel thoughtful rather than pushy.

Besides, by analyzing such data, you can anticipate customer needs and suggest relevant products or services. When a customer feels understood, they're more likely to stick around.

Increased spending and retention

When customers load value into your closed-loop wallets or cards, they're more likely to return. It's not just about payment convenience; it means they have thought about committing themselves to your brand. Plus, seeing an available balance motivates additional purchases.

Smart loyalty mechanics, like tier-based rewards or spending milestones, turn transactions into engaging experiences. Customers start viewing their spending as progress toward meaningful rewards.

Emotional loyalty through exclusivity

Closed-loop payment solutions let you offer perks that your customers can't find elsewhere. This payment technology allows you to offer exclusive benefits like:

- Early access to sales

- Member-only events

- Special discounts

These offers and perks create a sense of belonging among customers. They also help you transform routine transactions into membership privileges.

Integration of loyalty programs

Your payment system and loyalty program work as one unified platform with closed-loop payment systems.

Points accumulate automatically, rewards are instantly available, and customers never miss out on benefits as opposed to traditional loyalty cards or complicated redemption processes.

Closed-loop wallet apps handle all the tracking and redemption automatically. This simplicity boosts program participation. Hence, customers earn and burn rewards without jumping through hoops.

Security and trust

Advanced encryption and limited access points make closed-loop prepaid cards and wallets particularly secure. Since transactions occur within your controlled environment, there are fewer vulnerabilities for fraudsters to exploit.

Clear privacy policies and transparent security measures show your customers that you take their privacy seriously.

When customers know their data and funds are protected within your ecosystem, they feel confident, which strengthens their relationship with your brand.

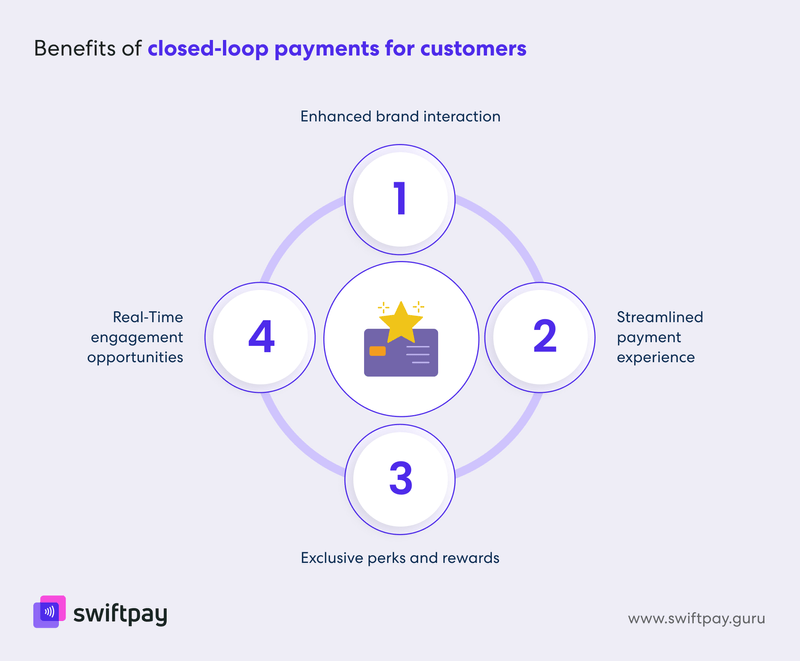

Benefits of closed-loop payment systems for customer engagement

Below are some key benefits of making closed-loop payments for shoppers:

Enhanced brand interaction

Every payment becomes a branded experience. Your closed-loop wallet app or payment card stays in customers' pockets, which means your brand is on their minds and you’re just a few taps away from conducting business.

These touchpoints create natural opportunities for meaningful engagement. Closed-loop payment systems allow you to control the entire customer journey, from payment to rewards. This oversight lets you fine-tune experiences based on customer feedback and behavior.

Streamlined payment experience

Transactions happen faster within your ecosystem as compared to third-party systems (open-loop payments). Your customers don’t have to wait for external payment networks or deal with declined cards. This speed and reliability make their lives easier.

You reduce dependency on external payment providers and cut out middlemen and any associated costs and complications.

Exclusive perks and rewards

Your closed-loop system enables unique rewards that wouldn't be possible with other traditional payment methods. Special discounts, early access to sales, exclusive products, or any other deals become powerful tools for driving loyalty.

These benefits feel more valuable because they're available only to members of your payment ecosystem. So, it’s also possible that more of your regular customers will want to get on board with your closed-loop payment options after seeing other fellow customers.

Real-Time engagement opportunities

Send timely and relevant notifications about special offers or account updates in your store’s closed-loop wallet app. These messages feel helpful rather than intrusive because they're based on actual customer behavior and preferences.

Apart from that, you can use transaction data to suggest complementary products or remind your customers about items they frequently purchase.

Read more: Top Use Cases Closed-Loop Payment Systems for Businesses

The economics of closed-loop payment systems

Cost savings for businesses

Closed-loop payments are processed in-house. Hence, it helps you eliminate various third-party costs while also gaining better control over your financial operations.

Each transaction costs less because you're not paying fees to multiple external processors. These savings can add up quickly, especially for businesses with high transaction volumes.

Increased revenue potential

Customers typically spend more when using closed-loop cards or wallets. The combination of stored value and integrated rewards creates a powerful incentive for larger purchases.

Unredeemed balances (breakage) become additional revenue, though it's important to encourage active usage rather than relying on breakage.

Boosting margins through loyalty integration

Strategic rewards and discounts tied to your closed-loop payment system can increase purchase frequency while protecting margins. You can offer more valuable rewards because you're saving on payment processing fees.

Conclusion

Surely, by now you must be convinced that closed-loop payment systems are a tech upgrade for your business. Indeed they are. But they're also your ticket to turning transactions into relationships.

You see, beyond the obvious benefits of lower costs and smoother payments, these systems create a space where your business and customers can truly connect.

And you know what? Knowing the potential isn't enough.

Your next move matters. Hence, let SwiftPay help you transform this potential into reality, and give you the tools to build your own financial ecosystem that keeps customers coming back to your store.

Ready to turn your payment system into a loyalty engine? Our experts at SwiftPay are here to show you how to do this. Reach out to us about creating a closed-loop solution that fits your business perfectly.