Running a restaurant is a high-stakes balancing act—juggling tight profit margins, unpredictable customer demands, staffing headaches, and the relentless pressure to deliver an exceptional dining experience every single day.

And then payment systems often add an extra layer of frustration you didn’t sign up for. Rising processing fees, disjointed chaos of managing credit cards, delivery app integrations, and managing tons of different payment methods—all of that is enough to make you feel like you’re losing control of a crucial part of your business.

What if your restaurant payment system could do more than just process transactions? What if it became a tool for building loyalty, increasing efficiency, and unlocking valuable customer insights?

That’s exactly what a closed-loop payment system for restaurants offers. These specialized payment methods—operating through branded gift cards, apps, and e-wallets—don’t just simplify payments; they redefine how you connect with your customers and grow your business.

In this guide, you’ll get to know ten critical ways closed-loop payments can transform your restaurant. And how you can make every transaction an opportunity for sustainable growth and stronger relationships.

Let’s start with understanding the closed-loop payments and how they work.

What are closed-loop payments?

Let’s break down what closed-loop payments are and why they’re gaining traction in the restaurant industry.

Definition and key features

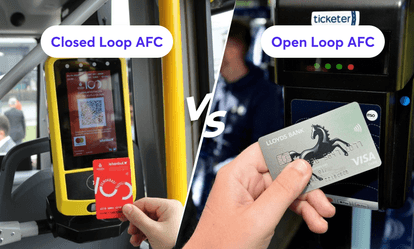

Closed-loop payment systems function exclusively within a specific merchant ecosystem. In the case of the restaurant business, think of them as restaurant-specific gift cards, branded mobile apps, and integrated loyalty programs. Unlike open-loop systems (such as credit cards), these payment methods are designed for use only at your business.

The defining feature? Your restaurant acts as both the issuer and the acceptor of the payment. This gives you complete ownership of the transaction process.

Why they matter for restaurants

Closed-loop payment systems offer your restaurant business more than just a way to process transactions. They create direct financial relationships with your customers. Hence, it helps you bypass third-party fees and gain deeper control over payments.

These systems also pave the way for advanced loyalty rewards, personalized offers, and valuable customer insights—tools that open-loop systems simply can’t match.

Now let's explore the specific advantages and insights that make closed-loop payments invaluable for your restaurant and your customers:

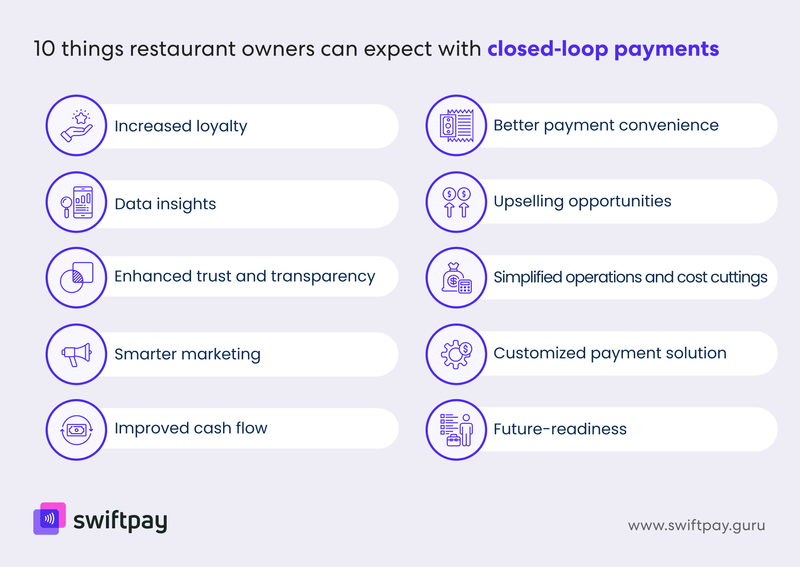

10 things every restaurant owner should know about closed-loop payments

1. Loyalty

Closed-loop payments serve as the backbone for advanced loyalty programs that recognize and reward your regular customers.

Instead of punch cards that get lost or forgotten, digital accounts (in a closed-loop wallet app) track spending automatically and reward customers based on actual behavior.

You can implement tiered rewards that increase in value as customers spend more. This will encourage your customer to add more things to their carts. The most successful programs offer immediate gratification like birthday rewards, surprise discounts on favorite items, or exclusive access to special events and menu items.

Read more: How Closed-Loop Payments Build Loyalty and Boost Engagement

2. Convenience

Payment friction remains one of the biggest pain points in dining experiences. In a collaborative survey from PYMNTS and Paytronix, payment features and loyalty & rewards programs were among the top reasons that would encourage consumers to place more orders.

Closed-loop payment systems for restaurants streamline this process through faster checkout options that eliminate waiting for servers to run cards or make changes.

Apart from that, mobile app integration means your customers can pay instantly from their table, while stored payment information removes the need to carry physical cards. This frictionless payment experience particularly appeals to younger diners who expect digital convenience.

3. Insights

Traditional payment methods provide minimal information beyond transaction amounts. Closed-loop Prepaid card systems for restaurants or e-wallets can equip you with rich behavioral data like:

- Visit frequency

- Preferred items

- Average spending

- Peak ordering times

This information enables you to identify your top customers, understand seasonal patterns, and recognize menu winners and losers.

You can use this data to adjust your staffing levels, customize promotions based on actual preferences, and identify opportunities to reach out to lapsed customers before they're gone for good.

4. Upselling

Psychological research into buying behavior shows that customers spend more freely with stored-value systems as compared to cash or credit cards.

Closed-loop gift cards or pre-loaded e-wallets typically result in customers spending more than they initially intended.

Businesses like yours can capitalize on this tendency by suggesting premium upgrades or limited-time specials through their payment app. Another effective strategy is to offer rewards that kick in just above typical spending thresholds. This will compel your customers to add that appetizer or dessert to reach the next tier.

5. Trust

Your payment system represents a direct extension of your restaurant's brand identity.

Customized e-wallets or physical gift cards featuring your restaurant's aesthetics act as mini-billboards in customers' phones and wallets. Each interaction with your payment system reinforces brand recognition and it subconsciously keeps reminding them about your business.

This sustained connection builds familiarity that translates into preference when diners decide where to eat. Using this kind of restaurant payment solution is an opportunity for you to turn your casual visitors into brand advocates who will recommend your restaurant to others whenever they get the chance.

6. Efficiency

The cost of accepting payments (like processing and network fees) remains a pain point for 30% of business owners as per a report by Fit Small Business.

Credit card processing fees typically range from 2-3% plus fixed transaction fees. These costs directly impact already thin restaurant margins.

Closed-loop payments can reduce these expenses to a great extent. Beyond fee reduction, this payment method can also streamline your business operations by:

- automating reconciliation

- reducing cash handling errors

- minimizing theft risks

Besides, digital receipts cut paper costs and simplify expense management for your customers.

7. Marketing

Closed-loop payment systems for restaurants transform generic marketing into precision targeting. Instead of going for mass discounts that erode margins, restaurant owners like you can send personalized offers to your customers based on actual preferences and behavior.

These systems excel at well-timed promotions, such as sending happy hour invitations to customers who haven't visited in the last 30 days, or promoting new menu items to customers who enjoy similar dishes.

The measurable nature of closed-loop payments means businesses like yours can track offer redemption rates and calculate the exact ROI for each promotion.

8. Flexibility and Customization

Unlike rigid third-party payment methods, closed-loop payments adapt to fit your specific operational needs.

Restaurant owners like you can modify reward structures, payment interfaces, and promotional strategies as your business conditions change. If you have restaurants in multiple locations then you can implement unified systems and accommodate location-specific offers.

This kind of flexibility extends to integration capabilities as modern closed-loop platforms connect seamlessly with existing POS systems, online ordering platforms, and kitchen management software.

9. Cash Flow

Pre-loaded payment balances and gift card sales generate immediate revenue before food costs are incurred.

This upfront cash improves working capital and helps smooth out seasonal fluctuations. Plus, automatic payments reduce the delay between service delivery and fund availability compared to traditional credit card processing.

For financial planning, the predictable revenue patterns that emerge from closed-loop transaction data help restaurant owners like you to make more informed inventory purchases and staffing decisions.

10. Future-ready

Consumer payment preferences continue evolving rapidly toward digital and contactless options. Worldpay’s report states that digital wallets became the most preferred payment method for customers in 2023. On average, 3 out of 10 consumers used digital wallets to complete their shopping. Apart from that, 79% of transactions in physical stores around the world were contactless payments (tap-to-pay) as per Visa.

Restaurants without modern payment capabilities increasingly appear outdated to younger customers. Beyond current trends, closed-loop payment systems position your restaurant to adopt emerging technologies like biometric verification, or AI-driven personalization without major infrastructure changes.

Final thoughts

Your payment system might seem like just another operational detail, but as we've explored, closed-loop payments fundamentally reshape the economics of your business.

The most successful restaurants see their systems not as mere transaction processors, but as relationship builders that connect their restaurants directly to their customers' wallets and behaviors.

Are you looking for something a similar payment solution for your restaurant? Then SwiftPay’s closed-loop payment solution is what you need.

When properly implemented, our closed-loop payment system solves several critical challenges simultaneously such as:

- High transaction costs

- Complex operations

- Poor payment experience

- Limited data insights

Consider evaluating your current payment approach against these ten insights. Are you capturing customer data that could inform better decisions? Are unnecessary transaction fees eating into your margins? Does your payment process enhance or detract from the dining experience you've worked so hard to create?

Business owners who recognize payment systems as strategic assets rather than necessary evils are setting their restaurants up for long-term success.

Connect with our experts to know how you can create sustainable advantages that build lasting financial stability.