Every swipe, tap, and click is reshaping retail. A 2023 McKinsey report stated that cash transactions plunged by 4% globally in 2022, and digital payments surged ahead. Even more telling: electronic transactions have been growing at nearly triple the rate of overall payment revenues over the last five years.

The same report also reported that over the last five years, electronic payment volumes have been surging at 17% annually—nearly triple the 6% growth in overall payment revenue. This highlights the shift in payment preferences, a move toward lower-cost options, and shrinking margins as scale increases.

So what does that mean for businesses?

The future of payments isn't just digital; it's personalized and brand-integrated.

There are multiple digital payment methods and most of them allow little to no personalization and branding. So, how can retailers like you offer that to their customers?

The answer is retail closed-loop wallet systems. Closed-loop wallets offer a unique model where payments and loyalty converge into one seamless system.

These apps are designed specifically for your business. With growing adoption across various industries, many retailers are embracing these systems to build stronger customer relationships, streamline operations, and create more value for every transaction.

This blog takes a closer look at how closed-loop wallets are revolutionizing retail payments. You will get to know:

- Basic concept of closed-loop wallets and how they work

- How they revolutionize retail payments

- Why modern customers like closed-loop wallets

What to consider when implementing this innovative solution in your business

Let’s start by understanding closed-loop wallets and their working.

What are closed-loop wallets and how do they work?

As a retailer, I’m sure you know about store credit accounts that many businesses offer (or used to offer). Usually, store credits are given to customers when they make purchases or return any products and they can be used only in the store that issued them.

In a similar way, a closed-loop wallet is the modern, digital version of that trusted business practice—but with instant payments and better security.

Just as those store accounts give customers a strong reason to come back to your business because those credits can only be used at your store, closed-loop wallets also create an exclusive payment pathway between you and your customers.

Your customers add money to their wallets (your store’s specific app). And these funds work only within your retail ecosystem—your stores, your website, and your app. No outside transactions, no third-party complications.

For you as a retailer, this means taking back control of your payment environment. Instead of watching transaction fees eat into your margins every time a transaction is processed, you're managing a direct payment channel with your customers.

Closed-loop wallets are pretty much like having your own small banking system but without the regulatory headaches. Your customers get a seamless way to pay, and you get lower processing costs plus a powerful tool to drive repeat business.

A step-by-step process of a closed-loop wallet transaction

When a customer visits your retail store or logs into your store’s app. Here’s how a closed-loop transaction in retail works:

-

Loading funds: The customer tops up their wallet by linking a bank account, credit card, or paying cash at the store. Think of it like pre-paying for a meal at your restaurant—customers fund their future purchases.

-

Making a purchase: At checkout, the wallet allows them to pay with just one tap or scan—no fumbling for cards or cash. It’s as if their payment process is already queued up and ready to go.

-

Balance management: Post-purchase, they can instantly check their remaining balance. Any rewards or loyalty points earned during the transaction are also reflected in the wallet.

-

Refunds and credits: If they need to return a product, the refunded amount is credited back to their wallet. It’s like returning a ticket to a movie theater and receiving store credit for your next visit.

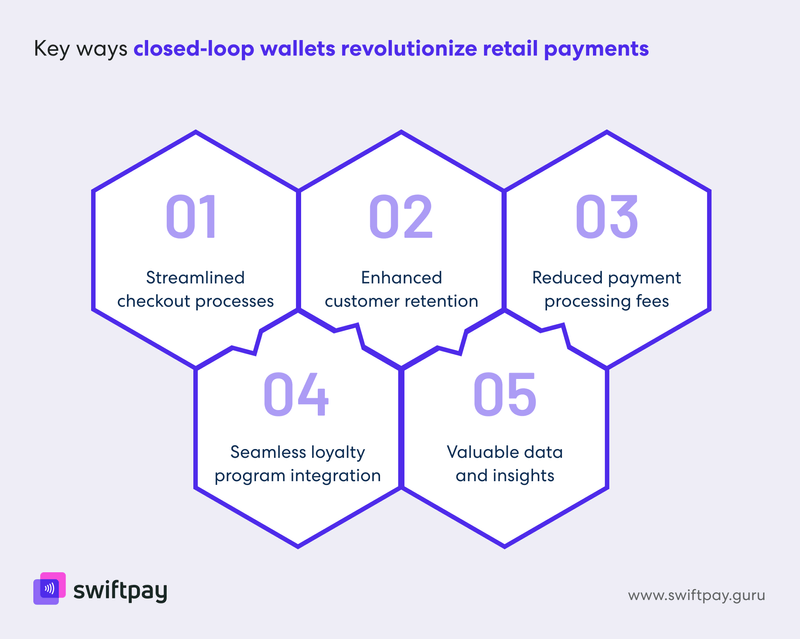

Key ways closed-loop wallets revolutionize retail payments

Here’s how closed-loop wallet solutions can help retailers like you get the best out of your business through a dedicated payment method:

Streamlining checkout processes

Closed-loop wallets help you remove unnecessary friction points at checkout. When your customers finish their shopping and they just want to pay, they often have to wait in queues to complete transactions.

In the case of closed-loop wallets, they will have preloaded funds; they don’t have to pull out their wallet, swipe a card, or enter a PIN. Closed-loop transactions are almost instant.

For retailers like you, this means shorter lines, faster checkouts, and happier customers who are less likely to abandon their carts in your store.

Enhancing customer retention through exclusivity

When you offer a store-specific wallet, you are giving your customers a strong reason to keep coming back.

To better understand it, let’s consider a hypothetical but real-world scenario. Your customers would surely see the difference between dining at a restaurant where they get exclusive discounts as a regular compared to one that treats everyone the same regardless of how many times they visit.

This is where closed-loop wallets can help businesses like yours foster loyalty by creating an ecosystem where your customers earn rewards that can only be redeemed within your brand. These exclusive perks in the form of cashback, special discounts, or early access to sales make your store feel like a premium destination.

Reducing payment processing fees

Processing fees for open-loop (traditional) payment methods, especially credit cards can eat into your profits. Closed-loop wallet systems help you keep more revenue in your pocket because these systems do not need any external parties or networks to process transactions.

Consider this as growing your own vegetables in your backyard instead of buying them from a grocer; you cut out the supply chain and enjoy the benefits firsthand. These savings can be reinvested into loyalty programs or passed on to customers as better deals.

Facilitating loyalty program integration

Closed-loop wallets and loyalty programs go hand in hand. With this integration, your customers can earn and redeem points directly from their wallets during closed-loop transactions. They don’t need to carry loyalty cards or remember account numbers; it’s all integrated into the wallet app.

For example, when a customer shops with your store’s closed-loop wallet, they see their points automatically updated in real-time. It’s as rewarding as getting an instant thank-you note for their purchase. Retailers like you can even create personalized offers that pop up in the app by displaying messages like “Earn double points on your next purchase!”

Gaining actionable customer insights

Closed-loop wallet apps can do much more than just handle payments—they can also fetch some valuable data. Studying and analyzing that data can give you insights into:

- Shopping habits

- Preferred products

- Spending patterns and much more

Again let’s consider a hypothetical but real-world scenario to get a clear idea. So, when you know exactly which items are popular during the holiday season or you identify numerous loyal customers who frequently shop on weekends, such data or patterns can help you in:

- Fine-tuning promotions

- Planning inventory more effectively

- Sending hyper-targeted offers that resonate with individual shoppers

Read more - Guide to Choose the Right Closed-Loop Wallet Solution for Your Business

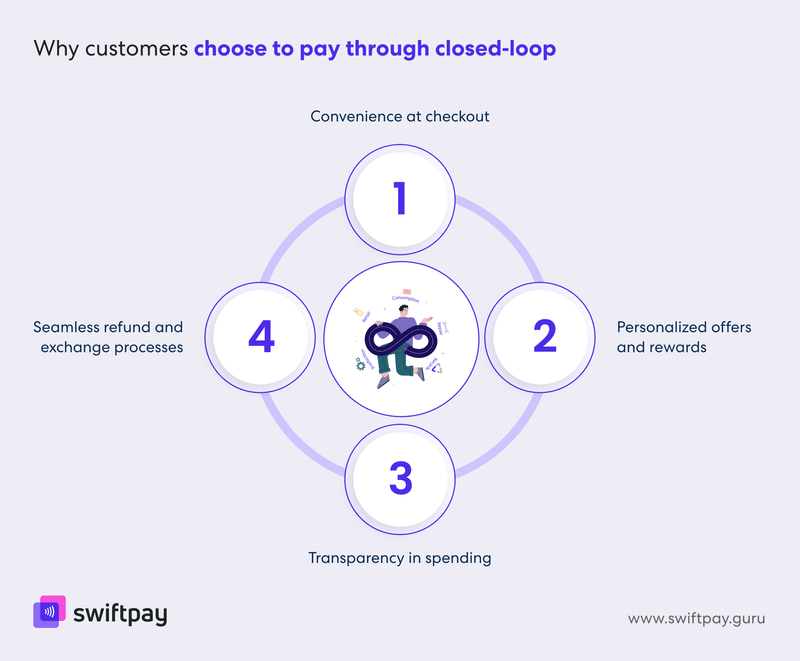

Customer experience: What shoppers love about closed-loop wallets

Convenience at checkout

Customers love how closed-loop wallets simplify ordinary day-to-day payments. With preloaded funds and instantaneous payment approvals, the checkout process feels effortless.

Personalized offers and rewards

Customized rewards help your customers feel recognized and valued. Whether it's a birthday deal or a special cashback incentive, your customers are more inclined to remain loyal when they sense appreciation.

That’s exactly what closed-loop wallets can help you achieve. These wallet apps make delivering these rewards as simple as pressing a button.

Transparency in spending

One major perk of closed-loop wallets is their transparency. This is simply because your customers can track every penny spent and see exactly where their money is going. It’s like having a personal accountant within the wallet app who ensures they stay on top of their expenses. Plus, they can even set spending limits if they want.

Seamless refund and exchange processes

Refunds can often be a pain point for your customers. Closed-loop wallets ease this frustration by instantly crediting refunds back to the wallet.

There’s no waiting for bank processing times or dealing with reversed credit card charges. Customers appreciate this swift, no-hassle approach, which boosts their trust in your brand.

How to choose the right closed-loop wallet solution for your business

Selecting a closed-loop wallet solution is a critical business decision that impacts your operations, customer experience, and bottom line. Here's what to consider when making your choice:

Assessing key features

Your closed-loop wallet needs to work seamlessly with your existing systems while also offering new opportunities for growth. For that, you should focus on core functionalities like:

- POS integration that works on day one

- A loyalty program that drives repeat business

- Security features that protect you and your customers

Evaluating scalability

Don't just focus on solving today's problems that bring short-term results; you should consider preparing for tomorrow's opportunities as well.

Hence, your chosen solution should handle your current transaction volume with ease while being ready to scale as your business expands. Consider whether it can support:

- Multiple locations

- New product lines

- Innovative reward structures

Partnering with the right provider

Success hinges on working with a provider who understands retail operations. That’s why you should look for solution partners with a proven track record in your industry and the technical expertise required to deliver customized solutions. This shoule be as per your specific business needs. You also need to make sure they offer clear implementation timelines and ongoing support.

Creating an intuitive customer experience

Your customers shouldn't require a manual to use your wallet; it should be self-explanatory. The interface should be clean and intuitive to make it easy to:

- Add funds

- Check balances

- Make payments

Remember: every extra tap or click is a potential reason for customers to abandon your wallet app.

Prioritizing security and compliance

In digital payments, trust is non-negotiable. Your closed-loop wallet solution must meet current security standards and regulations like PCI DSS, GDPR, or any other closed-loop wallet regulations. Plus, it should also be prepared to meet emerging requirements.

You should consider providers who offer:

- End-to-end encryption

- Real-time fraud monitoring

- Regular security updates

Final thoughts

If you considered closed-loop wallets as just a new payment method then I��’m sure your perspective must have changed after reading this blog.

You now know how they can be a strategic advantage for retail businesses. These systems help you empower your business to strengthen customer loyalty while also gaining valuable insights to drive better decisions.

The key benefits of closed-loop wallet include:

- Lower transaction costs

- Nurturing exclusivity

- Personalized shopping experiences

- Brand recognition

For shoppers, these wallets bring unmatched convenience, personalized rewards, and transparency, which transforms mundane transactions into meaningful interactions.

Retail space continues to evolve; hence, adopting technologies like closed-loop wallet systems can position your business at the forefront of this transformation and help you stand apart from your competitors.

It’s time to take control of your payments, enhance customer experiences, and future-proof your business. And that’s exactly what SwiftPay can help you do. Get in touch with our closed-loop payment experts to tailor a closed-loop wallet system to suit your unique needs. This is your first step in redefining payments and customer loyalty in your store.