The difference between a $10,000 and $100,000 month at your restaurant often boils down to how customers pay you—not just what they order. While you've perfected your menu, your restaurant payment system might be quietly sabotaging your growth.

Payment issues like technical glitches, long wait times, or high fees can lead to customer dissatisfaction and potentially reduce repeat business.

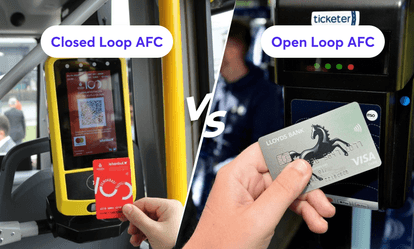

Closed-loop payment systems aren't just for theme parks and campuses. Many forward-thinking restaurants and cafes are deploying these self-contained payment ecosystems to create frictionless experiences that lock in loyalty while unlocking unique operational advantages.

The secret? Not all closed-loop payment systems deliver equal results. The five features outlined in this blog separate transformative tools from expensive distractions.

Let’s explore the five must-have features in your restaurant’s closed-loop payment system.

Prepaid dining cards

Your customers crave speed and simplicity in their dining experience. A sophisticated closed-loop payment system built around prepaid dining cards delivers exactly that. Let’s see how it can transform how your customers interact with your business:

Convenience for customers

Prepaid dining cards eliminate payment friction points. They play a big role in reducing wait times and enhancing the overall dining experience.

This means your regular customers can just walk in, order their favorite meal, and complete payment with a simple tap of a card. No waiting for card processing. No fumbling for cash or change. No annoying delays.

During busy lunch hours or high-volume periods, this streamlined approach can cut transaction times remarkably compared to traditional payment methods.

Increased cash flow

Closed-loop prepaid cards fundamentally change your restaurant’s financial rhythm. How?

So, rather than collecting payment after service, you receive funds upfront when your customers load their cards. This reversal creates a steady cash flow cushion. Hence, you will have a working capital you can invest back into your business.

This type of financial advantage becomes particularly powerful during seasonal fluctuations when having accessible operating funds matters most for businesses like yours.

Loyalty and retention

Prepaid cards naturally become loyalty tools. It’s pure logic—all the customers who have loaded balances in their cards are significantly more likely to return to your restaurant.

You can further incentivize this and make it more rewarding for your customers. For example, you can offer a 5% bonus for $50 reloads or 10% for $100.

This approach transforms a simple payment method into a powerful retention mechanism that keeps customers coming back to redeem their existing balance while adding more funds.

Mobile top-up & balance tracking

Your food and beverage payment system should extend beyond your physical location and create flexibility that both your customers and your staff appreciate. Here’s how closed-loop payment systems for restaurants can do that:

Seamless recharging

Mobile top-up capabilities free your customers from location constraints. Whether they're at home planning their next visit or already seated at your cafe or restaurant, they can instantly add funds to their closed-loop card/wallet through their smartphone.

This convenience removes barriers to spending and encourages larger deposits. The psychology here is that customers who can reload anytime typically maintain higher average balances than those limited to in-person transactions.

Real-time balance tracking

Nobody likes any uncertainty about their funds. Besides, customers deserve to have transparency about their money.

Modern closed-loop payment systems provide instant balance updates through smartphone apps. This transparency builds trust and eliminates awkward situations where customers attempt purchases with insufficient funds.

Also, clear visibility into available balances subtly encourages your customers to reload before reaching zero. Hence, it maintains continuous engagement with your brand.

Operational efficiency

Every minute your restaurant staff spends processing payments or handling reloads is a missed opportunity to engage with customers and assist them.

Closed-loop restaurant payment systems process transactions instantly, which means your team can become more customer-centric and make sure your customers are having the best possible experience.

This efficiency is even more valuable during peak hours when every second of service time matters.

Data-driven insights

Your payment system should be more than a transaction processor; it should be a strategic business intelligence tool. Here’s how a closed-loop food and beverage payment system makes it possible:

Customer behavior analysis

A robust closed-loop payment system captures detailed spending patterns that reveal exactly how your customers interact with your business.

You'll discover which customers visit during specific dayparts, their average order values, and their purchase frequencies.

These specific insights allow you to segment your audience and tailor your approach to different customer types.

Menu optimization

The payment data you get from your restaurant’s closed-loop payment system creates a clear picture of which menu items drive revenue and which underperform.

Beyond simple sales counts, these systems can reveal powerful insights like:

- Which customers typically spend more

- What menu item combinations are popular

- What customers prefer during breakfast, lunch, and dinner.

With these insights, you can optimize your menu based on actual data rather than guesswork.

Targeted marketing campaigns

Generic promotions produce generic results. Your food and beverage closed-loop payment system should enable personalized marketing based on actual purchase history.

For instance, with these systems, you can automatically send a special offer for breakfast items to customers who only visit during lunch, or you can target your happy hour promotion specifically to weekend-only visitors who haven't experienced your weekday offerings.

This level of targeting typically delivers a higher response rate as compared to generic promotions.

Multi-language and multi-currency support

In our increasingly diverse marketplace, payment systems that accommodate various languages and currencies create competitive advantages. Let’s see how closed-loop payment solutions for restaurants can do that:

Catering to diverse customers

Language barriers shouldn't become payment barriers. Advanced closed-loop e-wallets provide interface options in multiple languages, which allows customers to navigate payment processes in their preferred language.

This seemingly small feature significantly enhances the experience for non-native speakers and communicates that your business values inclusivity.

Simplifying international transactions

If you have your food and beverage businesses in tourist areas or international districts, then currency flexibility in your closed-loop payment system eliminates confusion and hesitation.

These systems display balances in multiple currencies and allow loading funds in various denominations to remove transaction friction for international guests.

Enhancing customer experience

When customers can use your restaurant’s payment system in their preferred language and currency, you convert a potentially confusing transaction into a seamless experience.

This attention to detail contributes to the overall impression that your business is caring, customer-focused, and globally minded – perceptions that extend well beyond the payment process itself.

Custom branding & cross-promotions

Your payment system should reinforce your brand identity. Plus, it should also enable you to create new marketing opportunities. Closed-loop payments make that possible, here’s how:

Brand visibility

Every interaction with your payment system represents a branding opportunity. Physical cards featuring your logo, colors, and design elements serve as pocket-sized advertisements. On the other hand, digital interfaces of closed-loop e-wallets should similarly reflect your brand identity.

All this combined creates a cohesive experience across all customer touchpoints. This consistent branding turns a payment system into a marketing asset.

Cross-promotional opportunities

Strategic partnerships amplified through your payment system can drive significant new business. You can consider arrangements where other businesses can offer special privileges to your restaurant’s closed-loop payment card or wallet users.

A nearby entertainment venue, for example, can provide discounts to your customers who use your branded payment card, or a local retailer can offer exclusive deals.

These partnerships create value beyond the four walls of your space while also driving traffic to your establishment.

Customer engagement

Your restaurant payment system should enable creative engagement strategies that surprise and delight your customers.

Closed-loop systems allow you to implement unexpected rewards like:

- Randomly add bonus funds to customer accounts

- Create birthday rewards that automatically appear on their special day

- Develop gamified elements that make payment more engaging.

These minor touches make transactions more memorable that your customers will enthusiastically share.

Read more - How Closed-Loop Payments Build Loyalty and Boost Engagement

Final words

A closed-loop payment system with these five key features does far more than process transactions; It transforms every payment into an opportunity to strengthen customer relationships and refine your business strategy.

Food and beverage business owners like you must understand that payment systems aren't just operational tools—they're strategic assets that directly influence revenue and customer loyalty.

Each tap of a prepaid card or mobile wallet creates data points that, when properly leveraged, reveal exactly how to optimize your menu, staff scheduling, and marketing budget. The competition in the food and beverage space will never be less intense. So can you afford a payment system that merely processes transactions rather than drives business growth?

Evaluate your current system against these five essential features. If it falls short, it's time to consider a comprehensive platform like SwiftPay that delivers the seamless experiences that your customers expect and the business intelligence you need.

SwiftPay can provide a powerful closed-loop payment solution designed for food and beverage businesses with all the must-have features you need.